|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Big Reversal in Gold. What's Next?...

Published: Wed, 01/15/20

|

|

|

The New Year started off strong but the gold stocks sputtered as Gold (and to a lesser degree Silver) surged higher on geopolitical tension. The gold stocks started lagging before tensions flared and never confirmed Gold's geopolitical led rise.

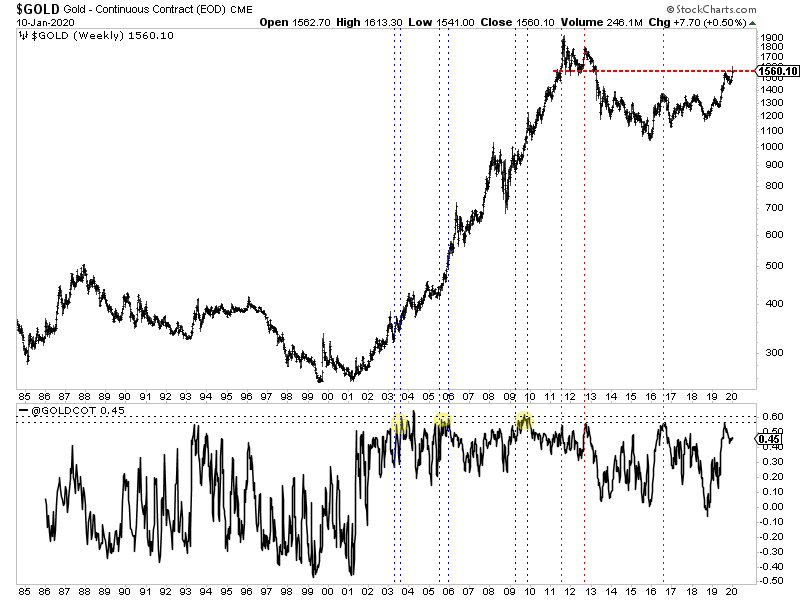

In this article, penned Sunday we cover what could be ahead. If you prefer the spoken word, then consider listening to these short interviews with Cory Fleck as well as Mike Swanson. Both were post-Wednesday's reversal. If the sector corrects that is a good thing because you can buy our favorite stocks on weakness and before they make huge moves higher. My favorite stock and one of my largest holdings is correcting right now and when it breaks above recent highs is going to have an explosive breakout. I love the company fundamentally and the chart happens to be giving us a good entry point. It has formed one of the most textbook bullish patterns. Your service is the single best for small cap gold and silver company insights and analysis. I have tried quite some subscription over the years and yours has been best of all hands down. Even though I've suggested covering more risky companies your caution and timing entries has been crucial to making money and I haven't found it anywhere else. By far TDG is the most valuable newsletter I've found. Speaking of my friend Mike Swanson, he joined me for episode #9 on the 10-Bagger Podcast. Mike gives us a history lesson. He informs us to who coined the term 10-bagger and when they did that. He speaks to where 10-baggers are really found (in markets in general) and then discusses which area of the junior sector he thinks 10-baggers will come from. He even shares a stock pick. Circling back to Gold, one reason I expect weakness is because of the high net spec position. There is a lot of fear mongering out there about the record in nominal terms. That's true but during the 2001-2011 period the nominal high continued to increase. Hence, I measure the net spec position as a percentage of open interest. When Gold is in a bull market, the high net spec position leads to a pause or correction in the market. When it is not in a true bull, like the 2011 peak, 2012 and 2016 peaks, there is a much longer period of weakness. A high net spec position by itself cannot cause a bear market.  Subscribe to TheDailyGold Premium for Only $149

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. Moving onto TheDailyGold Premium... We do have a little bit of cash left and we put some to work buying a company we think has 10-bagger potential in the next two to three years. It will be a steady riser and right now there is enough liquidity for you to get in board. Its possible it corrects 10%-12% if the sector corrects as I expect. We wrote a report on this company and explained exactly how it could be a 10-bagger. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|