|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Time for Gold Stocks & Silver to Lead...

Published: Tue, 02/25/20

|

|

|

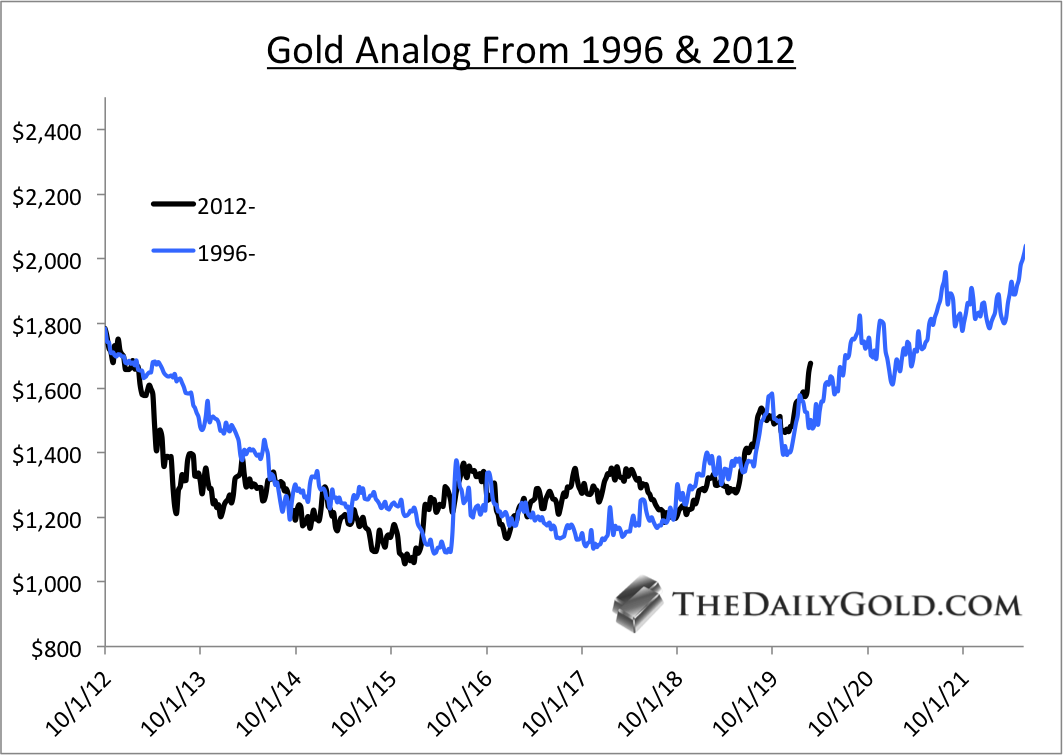

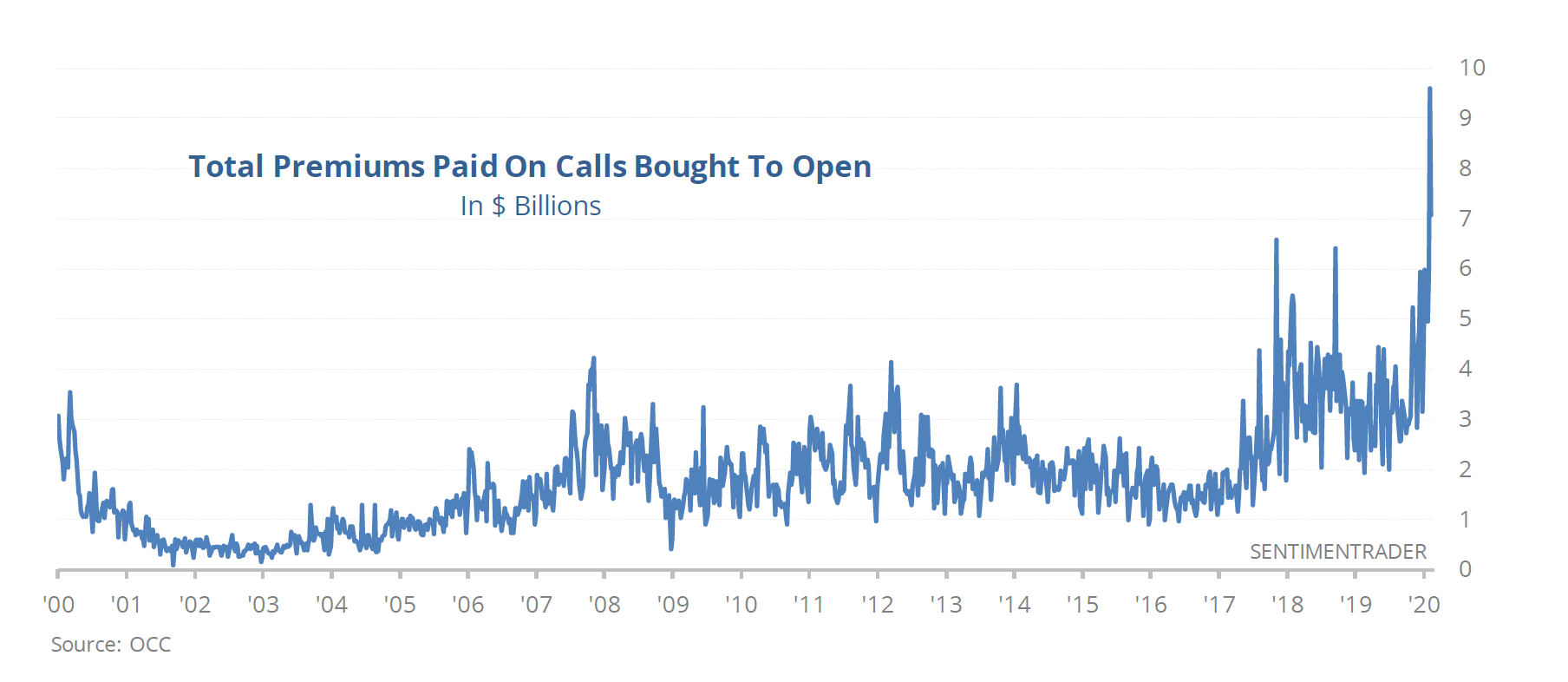

The setup is there for significant upside in GDX and GDXJ and the same can be said for Silver, which has lagged the most (in a long-term sense). What are the key levels in Gold & Silver, as well as in GDX & GDXJ? Click Here for my video analysis, published Sunday evening. Last week we published a video discussing the new Gold-Dollar correlation. Our Gold/foreign currencies basket closed last week 13% above its 2011 high. If Gold in US$ terms did that it would be trading at $2,150. That goes to show you how strong Gold is when removing the US$ strength. Below we plot an updated analog, comparing Gold from 1996 to Gold from 2012. Big picture, the best comparison is the early 1960s. But Gold didn't trade then. On a cyclical basis, the 2000s is a reasonable comparison considering the 1996-2000 bear was similar to the 2011-2015 bear. Gold was tracking quite closely but is now ahead of the analog, which made its next peak at $1800 in October.  This next chart is from Sentimentrader. It shows the premiums paid on call options in stocks. The higher this is, the greater bullish sentiment there is. Note the peaks in 2000, 2007, late 2017, late 2018 and now. Just imagine the fuel precious metals will gain if the stock market has a big correction.  I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. In TDG #661, we rated our companies by risk (1-5) and also by upside potential over the next 12-18 months and in some cases, 2-3 years. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|