|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Massive Reversal but Fundamentals Improving...

Published: Mon, 03/02/20

|

|

|

What the hell just happened?

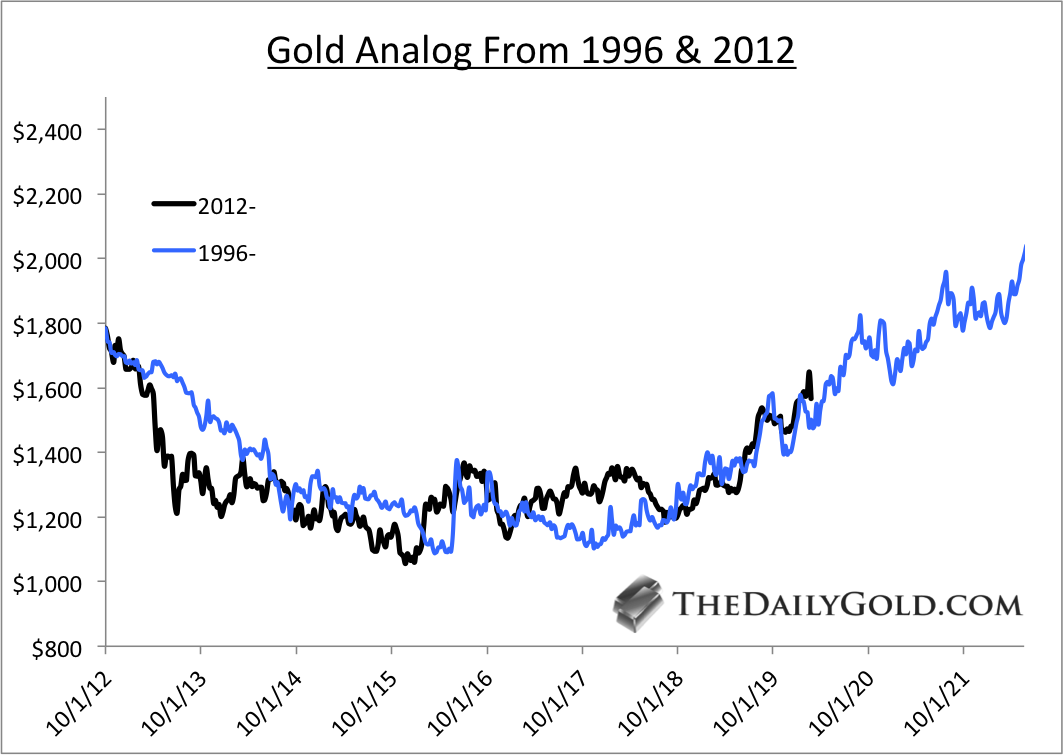

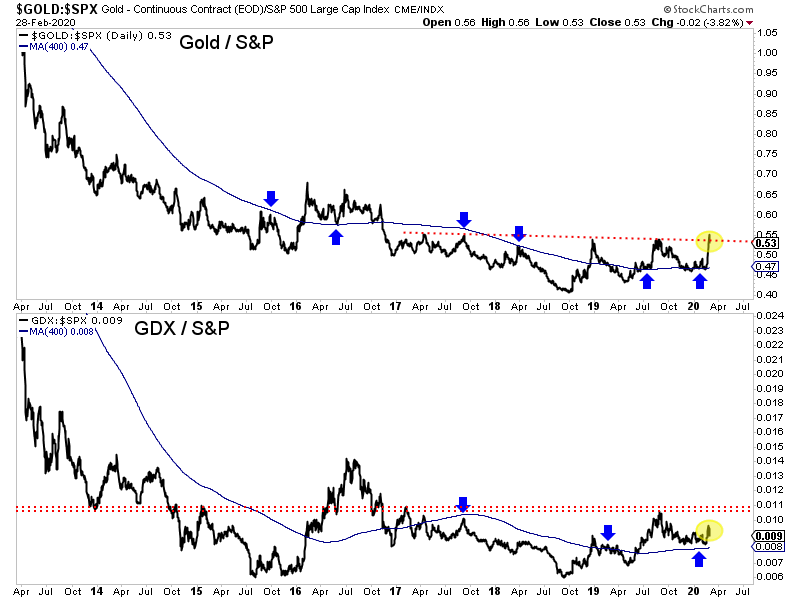

From an imminent breakout to potentially the single worst week for juniors in at least 7 years and probably 12 years. I try to explain and give key levels in this article. Elsewhere, Steve Saville writes about the Gold/Silver ratio approaching a 300-year high and what it means for the macro landscape. I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far to many companies. You seem to sift through the best and recommend a simple more condensed list with big upside. Below we plot an updated analog, comparing Gold from 1996 to Gold from 2012. Big picture, the best comparison is the early 1960s. But Gold didn't trade then. On a cyclical basis, the 2000s is a reasonable comparison considering the 1996-2000 bear was similar to the 2011-2015 bear. Gold surged above the analog over the past few weeks. The next corrective low for the analog is $1476. Then it runs to $1800 within the following 6 months.  This next chart is extremely important. To see a real bull market in precious metals we need these ratios to break up. It would signal capital moving out of stocks and into Gold and gold stocks. That would give this fledgling bull a significant boost. The Gold to S&P ratio is almost there. Could this corona virus be the trigger for these ratios breaking above resistance?  I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely! My how things can change in only one week. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|