|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: A False Breakout, Then a False Breakdown in...

Published: Fri, 04/03/20

|

|

|

One of the most random yet consequential months has ended.

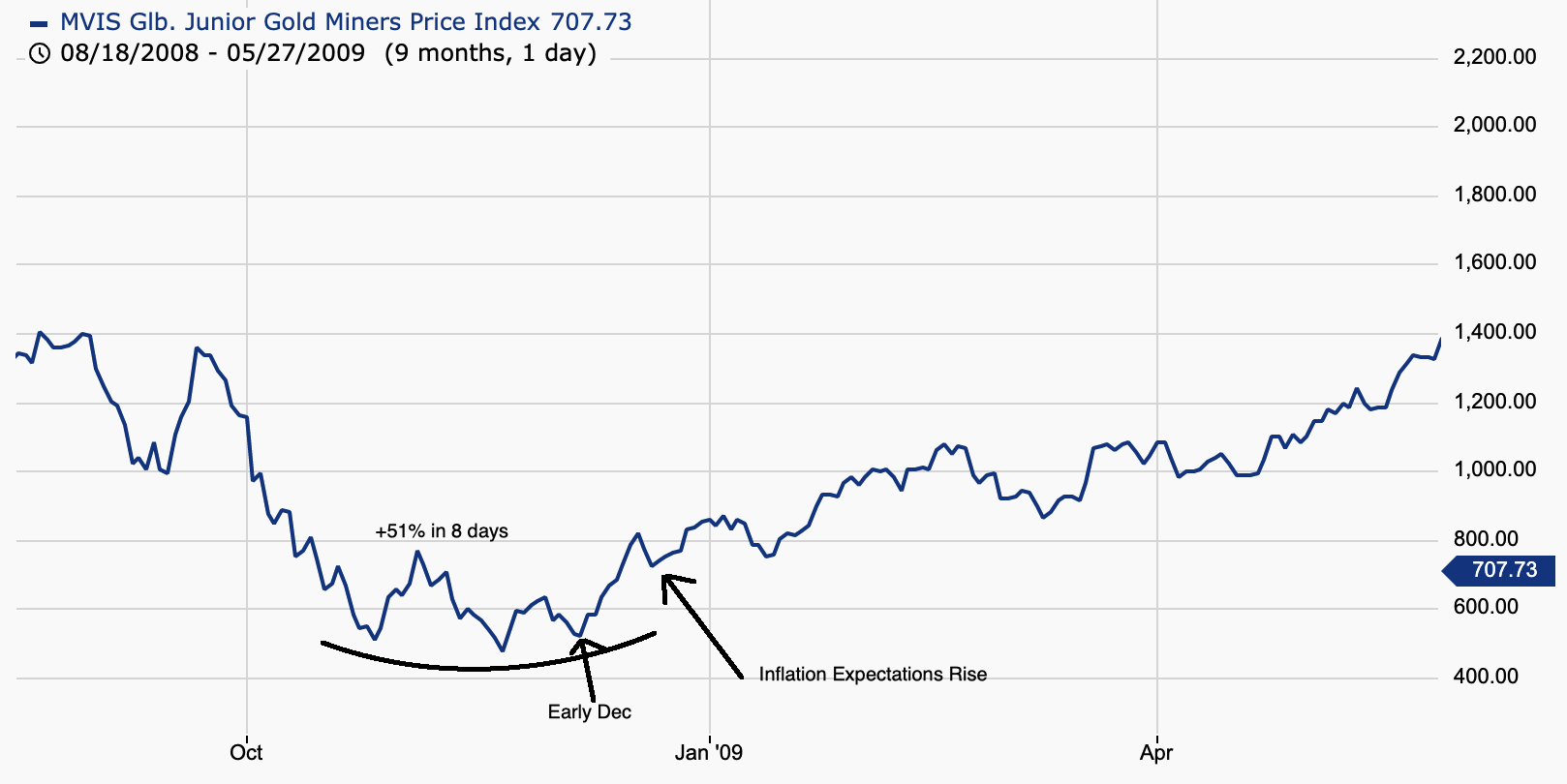

In our sector, in a little over a month we've seen a false breakout (to multi-year highs) lead to a crash and then a false breakdown (to multi-year lows). So, what is next? We share some thoughts in this article. If you prefer the spoken word, then take a listen to this interview. The 2008 experience is an obvious comparison for the purpose of anticipating the path forward. The chart below is the parent index of GDXJ, which dates back to 2004. The chart shows the bottom that formed between October 2008 and December 2008. GDXJ essentially formed three lows and spent five weeks grinding out a bottom until early December. Note that GDXJ recently rebounded 52% in 7 days.  I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Moving onto TheDailyGold Premium...

In TDG #667, we highlighted our top 8 positions amongst a coverage group of nearly 20 companies.

Given the new landscape we have to recalibrate as far as how these companies look in terms of risk and potential. I'm not one to be promotional or hyper-bullish but the recent policy developments could spark a real bull market in precious metals. That's one during which Gold would go well above $2000/oz and Silver potentially back to $50/oz. In that scenario, there are "high quality" juniors that could be 5 to 10 baggers. I'm not talking about the more speculative ones. Heck, some of those could be 15-20 baggers. I'm hoping juniors retrace most of the rebound. That would give us a second change at some potentially epic entry points on a number of stocks. Subscribe now to find the ones we are wathching! Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|