|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: This Will Lead to Many 5 & 10 Baggers in 12-18 months....

Published: Tue, 03/10/20

|

|

|

The question is how long this panic lasts?

On the other side, there is a good chance precious metals lead the upside charge. The setup is there for huge gains and the coronavirus panic has delayed the move but because of the policy reaction, boosted the upside potential. In this week's article, we analyze why Silver and the juniors have lagged, what needs to happen for them to outperform (there is a macro explanation) and why this is likely to happen when the virus is brought under control. The bad news is we are taking a hit because of the panic (please keep yourself safe) and it could continue into the spring. But the good news is this is going to lead plenty of 5 baggers and some 10 baggers over the next 12 to 18 months. In TDG #664, we wrote a report on a company that we think has 10-bagger potential. The stock has corrected quite a bit (which we predicted it would) but even more than we thought. (I would give you more hints but you might guess it). We are looking to buy a 3%-4% position because it is speculative. You should not try to be a hero during these panics but when something has a fishing line selloff and trades at a compelling valuation with 5x to 10x potential, you have to step up. I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Moving onto TheDailyGold Premium...

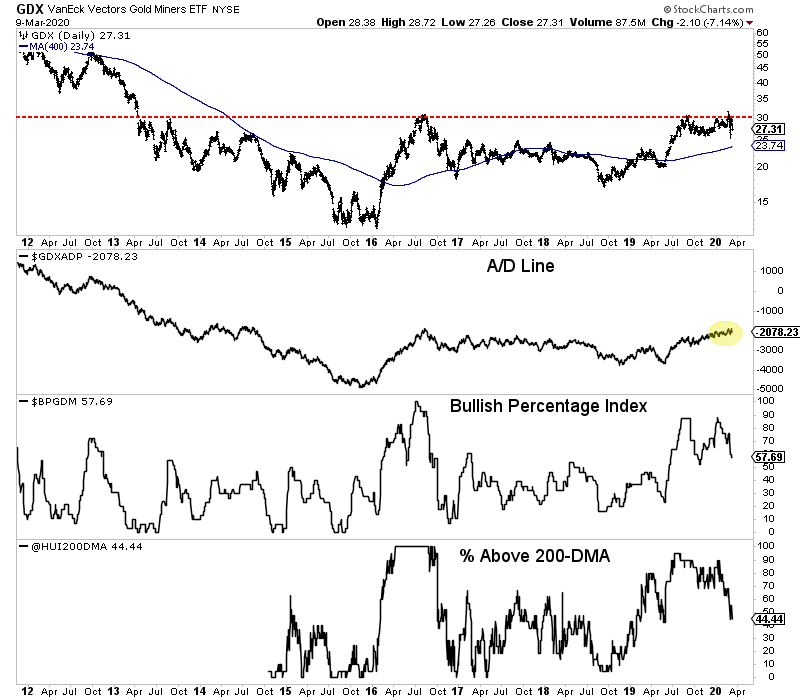

In the chart below, we plot GDX (daily) along with some breadth indicators.

Note how the 400-dma has been an excellent indicator of the primary trend since 2012. Note its level now. Also, the advance decline line has held up well so far depsite the selloff. The miners are very oversold on a short-term basis but not yet so on a medium to intermediate term basis (as the other two indicators show).  In TDG #664 we also published strong buy targets on our stocks. Catching the absolute lows will be extremely difficult but if you get close enough then you put yourself in position for big gains when these things recover.

In TDG #663 we noted the cash positions for each company we cover actively. Juniors that don't need to raise anytime soon will have a chance for sharp rebounds. It is going to be an exciting but volatile year. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|