|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: When Will Gold Bottom...?

Published: Mon, 03/23/20

|

|

|

It has been perhaps the most difficult month in the history of our sector. There are investors 90 years old who have not seen these kinds of moves. The ramifications obviously go well beyond the financial. I hope you are keeping yourself safe, healthy and sane. This will pass.

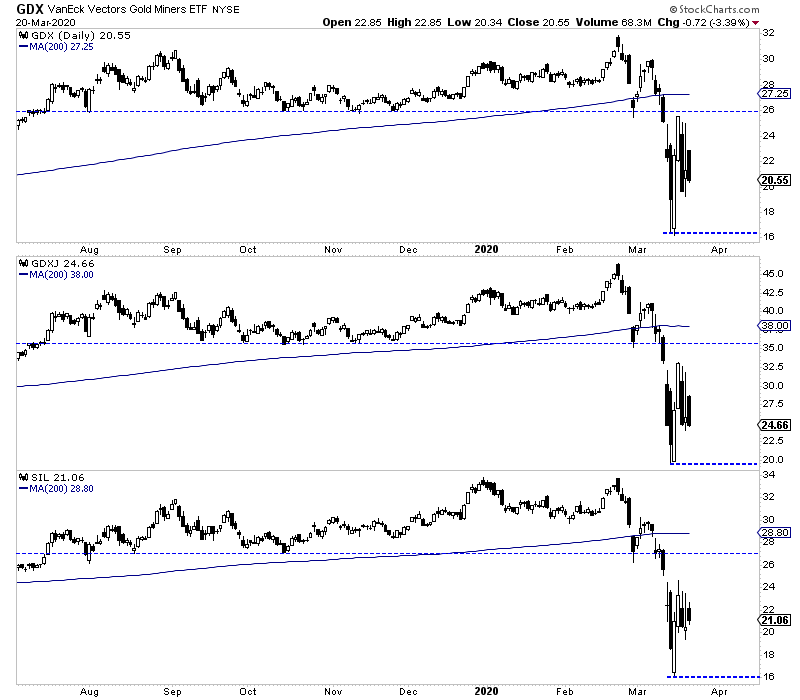

The obvious question for us is when will Gold bottom? When is the turn? I try to answer that in this editorial. Also, click here for my latest interview. In 15 minutes I discuss the outlook for Silver, juniors, the stock market and the CoTs. As I pen this, S&P futures are at 2187. The analog with 1929 calls for a bottom at 2135 and then a 33% rally. We could be setting up for a big rebound. The market is beyond extremely oversold. Below we plot the daily candles for GDX, GDXJ and SIL. If these miners decline close to their recent low but then form a bullish reversal candle, that could confirm a short-term low. For example, consider a reversal in GDX at $17 and then it could rally up to $24 again.  I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Moving onto TheDailyGold Premium...

In TDG #666, we published a watch list of producers, developers and explorers. We will broaden this list a bit to include silver specific companies and divide explorers into advanced and nano-caps.

This crash is producing exceptional values across the board. Companies with tier-1 potential projects are going for less than $100 Million. Companies with assets and strong potential have enterprise values below US $20 Million. Companies with highly prospective projects and potential beyond 10x are going for cents on the dollar. In TDG #666 we focused on producers and are top 5. One of the safest you can buy projects as a 10-bagger in 3 years if you buy it near the recent low and Gold surpasses $2000/oz. This is a stock you can buy and hold. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|