|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: A Potentially Historic Breakout in Gold Stocks...

Published: Tue, 04/28/20

|

|

|

The gold stocks have been on an absolute tear. They hit resistance and last week I argued that based on the rip roaring 2008 recovery, they (GDX) could test the 50-day moving average before moving higher.

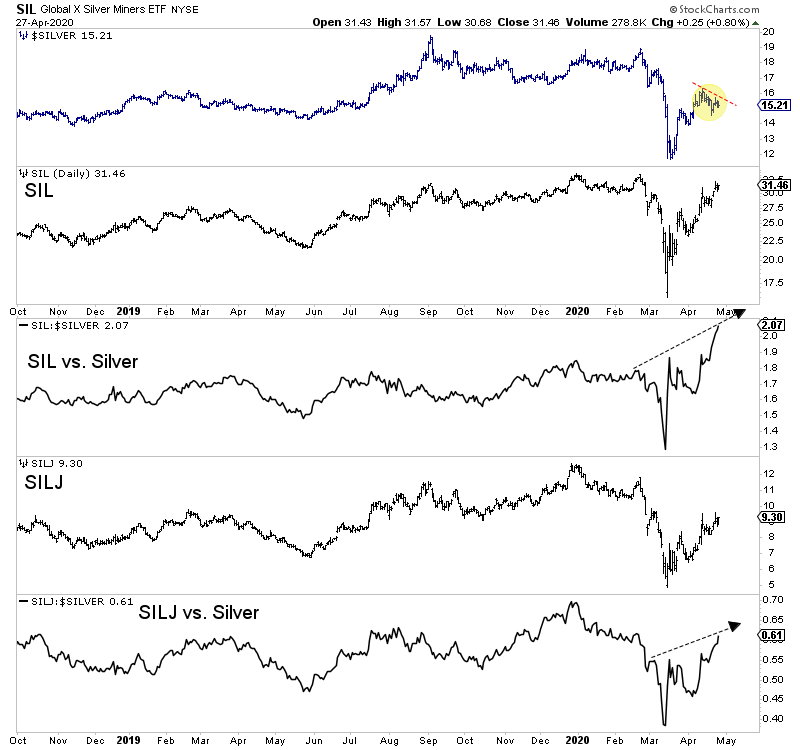

So much for that. GDX blasted through resistance and closed last week 10% higher in daily and weekly terms than the previous high. Sounds like a breakout to me! Here are my latest thoughts. If you did not click the link, here is a quick summary. Breakouts from long bases typically lead to at a minimum, a few good years of performance. Also, there are some reasons why we think gold stocks can repeat the 5-7 year runs they had in the 1930s, 1960s and 2000s. But we'll worry about the 3-5 year outlook later. If you are wondering when Silver is going to outperform Gold, take a look and listen to my analysis in this video. The action in the Silver space reminds me a bit of 2001-2002. The silver stocks followed the gold stocks and dramatically outperformed Silver in 2001-2002. Silver bottomed in late 2001 but didn't begin to outperform Gold until 2003. Below we plot Silver, SIL and SILJ and show how those ETFs are performing against Silver. SIL is killing it. Its trading about where it was at the September 2019 peak when Silver was almost $20/oz. This is a very good sign.  I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Moving onto TheDailyGold Premium...

In TDG #671 we updated a report on a company that is one of our three favorite explorers.

This company is one that tickes all the boxes. It has a simple story and its easy to understand. At Friday's price we deemed it a likely 3-4 bagger but with 5-bagger potential on the high end. There is now growing interest in the sector so TDG #671 was written somewhat to help newbies. We have a clear top 8 and top 11 companies as well as a top 17. We breakdown these groups with a list going by producer, developer, explorer. Those who want to take less risk can focus on producers and some developers, while those who want more risk can focus on explorers and developers with the most potential. Speaking of that we did mention our top 5 in terms of most potential. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|