|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Gold Stocks Test Multi-Year Resistance...

Published: Tue, 04/21/20

|

|

|

Gold & Gold Stocks reached multi-year resistance.

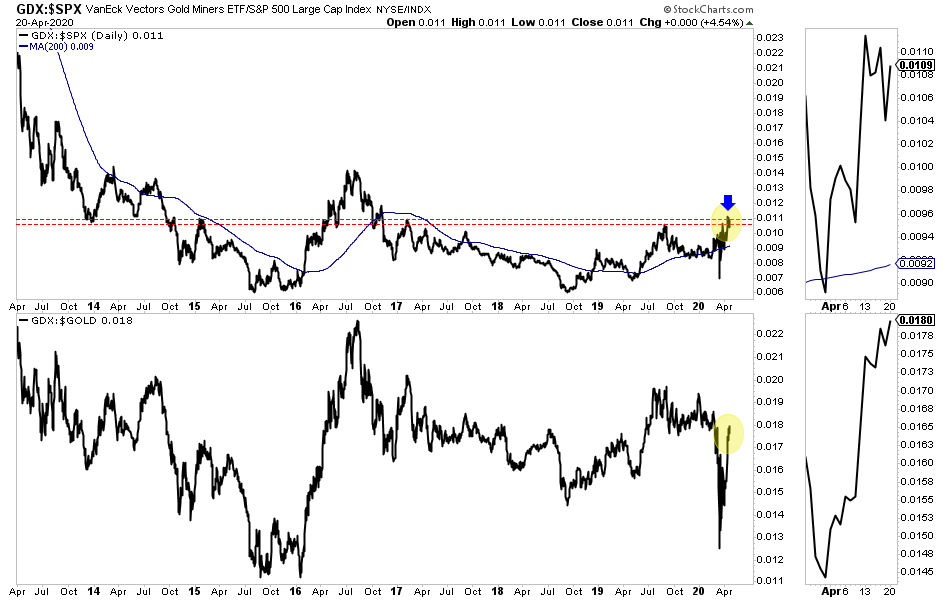

GDX hit 7-year resistance, which it tested for the 5th time in the past 7 years while Gold nearly reached $1800, which provided resistance three times in late 2011 through 2012. In the article above I made a comparison to the 2008 rebound and what it would mean for GDX right now. The sector is correcting but it has held up quite well in recent days. In fact, the stocks have performed better than the metals over the last 4 days even as the metals have declined. Anyway, for those who prefer the spoken word, click here for my most recent interview to listen to the interview. The title is clickbait as it cutoff my "in 15-20 years" time horizon. Technically, the key levels for Gold are $1800, $1900 and then $2750. If Gold can clear $1900 convincingly, then the measured upside target becomes $2750. Last week I mentioned the excellent setup we have for not only the next 6-9 months but also the next 2-3 years. GDX is on the cusp of potentially one of the most significant breakouts in gold stocks in history. It would be the 3rd most significant one in the last 60 years. Here are two ratios to watch which could serve as leading indicators for the breakout move. In the chart we have GDX/S&P (top) and GDX/Gold (bottom). Last week the GDX/S&P ratio broke to nearly a 3.5 year high. Now it is trying to "follow thru" to the upside. Note how GDX/Gold has recovered violently and has continued rising in recent days even as the sector has corrected.  I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Moving onto TheDailyGold Premium...

In TDG #670 we updated a report on a company we first covered and bought last summer.

This junior producer had all the ingredients to be a 10-bagger. And it still does- if Gold breaks past $1900-$2000/oz. If not, even at these prices it is in position to be a 5-6 bagger over the next 2-3 years. We also covered a junior producer that is a turnaround play. This company trading at a very low valuation and should see its valuation improve because of a recent development. Exploration success has been a huge driver for several of the best-performing junior producers. This company is finding exploration success at one of its projects. It's early in that game but if it continues it will be a REAL game changer for that company. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|