|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Healthy, Bullish Correction in Gold Stocks...

Published: Wed, 06/10/20

|

|

|

The risk from a few weeks ago, which we told you about it has mostly been removed. That does not mean the entire correction is over. It could go a bit deeper and perhaps a bit longer. But buyers are at a lower risk spot compared to two weeks ago when we said it was not time to buy.

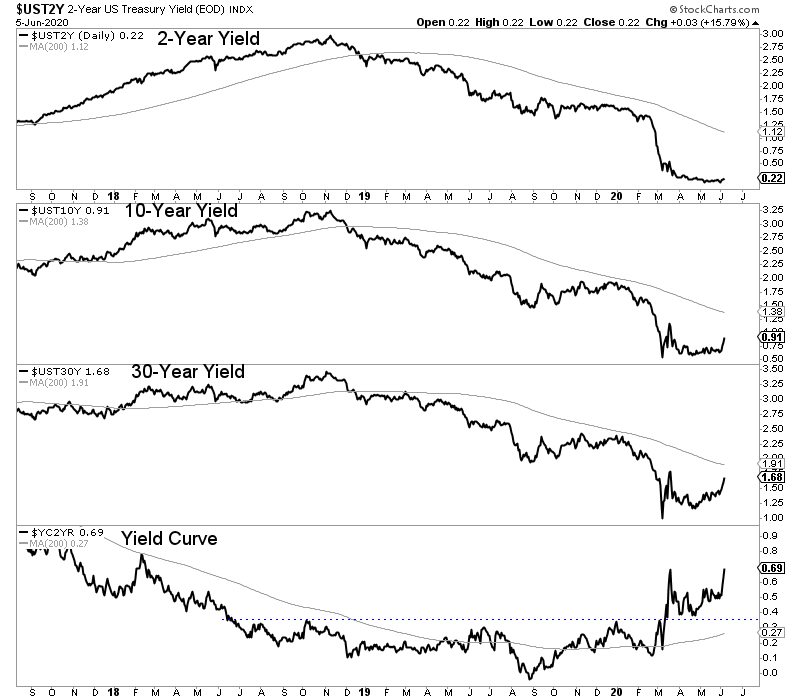

I discuss it here in my latest article. Moving along, here are a few things for you to listen to. First, here is a tip. If you are listening on YouTube, click the settings icon at the bottom right of the video player. Then click playback speed. If you listen at 1.5x, you can save yourself some time. I've been on some epic mining trips with Sean Brodrick, who is my guest for episode #16 of the 10-Bagger Podcast. We share a few laughs in this episode and he mentions a Silver company which could be poised for a long run with Silver moving. I was interviewed twice this past week. First, with Bill Powers of MiningStockEducation. He asks different from usual questions and the video player shows timestamps of all the questions. Here is my other interview with Cory Fleck of the KEReport, in which I discuss sector technicals. Moving on, here is a note on bond yields, the yield curve and Gold's fundamentals. A steepening curve, as yields are rising is a sign of increasing inflation expectations, which is bullish for Gold. Essentially, long-term yields rise much faster than short yields. This will happen in an inflationary scenario. The Fed will not hike rates until CPI is well above 2%. Short-term rates will stay anchored even if long-term yields rise. The initials shift from recession, negative rates, fear to rising inflation expectations causes Gold to get hit as it was bought for those initial reasons. But if the curve continues to steepen, that's bullish for Gold in the big picture.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

In TDG #677 we updated a report on one of our top 8 companies. This is a junior with, what appears to be a tier 1, world class asset. This is something a major will have to buy eventually.

We calculate how the stock, in a flat Gold market, could be at least a 4-bagger over the next 3 years. If Gold breaks past $1900-$2000/oz then the stock has 7x potential and perhaps up to 10x potential. We also added another company to our watch list. It ticks all the boxes but its asset is decent but not great. But they have a chance to add more value to it. When it comes to producers, growth and exploration upside lead to the best performance. That's what you should be looking for. In terms of explorers and developers here are a few things you should look for: growth potential of deposit, size potential of the deposit (the market likes big) and/or a deposit that gains the most relative value in a Gold bull market. Make sure you get into the best stocks. They are correcting now. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|