|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Key Support Levels in Gold, Silver & Miners...

Published: Sun, 06/14/20

|

|

|

The correction continues.

Here are the key support levels in Gold, Silver & GDX, GDXJ Moving along, take a listen to these interviews in which I discuss the technicals of the sector: Mike Swanson, starts at 4 minutes KEReport w/ Cory Fleck

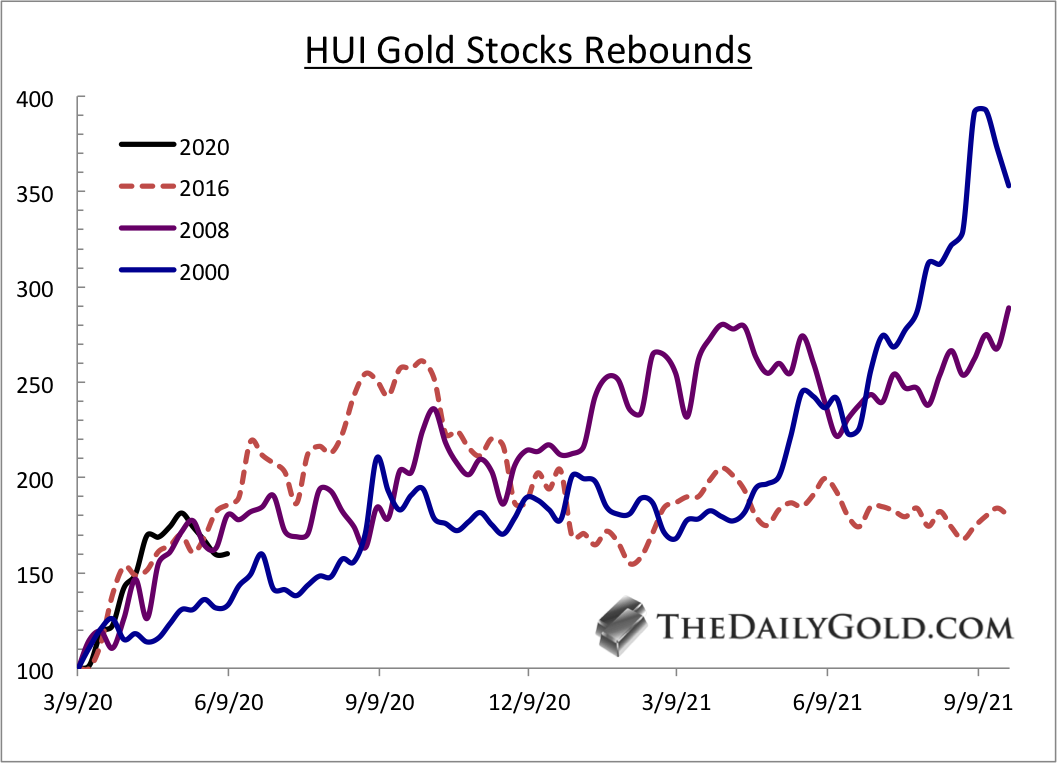

The story of the week, in terms of macro-market developments was the rebound in the Gold/Silver & Gold/S&P 500 ratios. Both ratios bounced at the rising 200-day moving average. I published a video a few days before the Gold/S&P ratio bounced. I analyzed the importance of the ratio. Click here for the video. Moving along, take a look at this chart. The rebound in the gold stocks 3 or 4 weeks ago was ahead of all the others. Now it's back to being in a healthy spot. One more down week from here should bring about a good opportunity.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

In TDG #678 we updated a report on one of our favorite silver companies. We think this company has the strongest potential to add the most high-grade ounces via drilling.

There aren't too many junior silver companies. The majority of them have low grade deposits. One can figure out how big deposits are valued right now. Low grade stuff is mostly below $1/oz in the ground. High grade can trade beyond $3/oz in the ground. Decent grade is around $2/oz. Using that info, among other info, we calculated that reasonable expectations give this stock 3x potential. If Silver breaks above $21/oz and they make another high-grade discovery, the stock could have up to 5x potential. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. We do have lower entry points on everything but even from here, there are more than a few stocks with 10x potential over the next 3-4 years. And most continue to have 3x-5x potential over the next 18-24 months. Make sure you get into the best stocks with the most potential. They are correcting now. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|