|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Here's Criteria for Buying Juniors Right Now..

Published: Thu, 06/25/20

|

|

|

Every once in a while I have to mix things up and write about something that is not technically related.

Here is a quick read on criteria I follow to help me find companies with 3x to 5x potential in the next 12 to 24 months. Here are two good reads from two of my favorite analysts: Gary Tanashian says the correction is maturing Steve Saville discusses the coming inflation

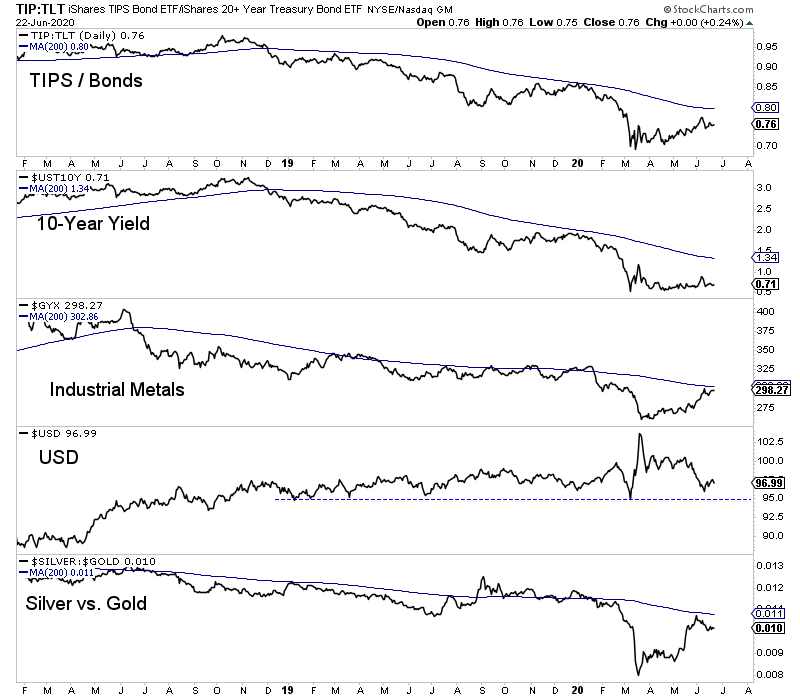

Moving along, take a look at this chart in which we plot indicators of inflation expectations. These charts have rebounded (and the dollar has declined) but they need to go a bit further to confirm a sustainable rebound in inflation expectations. That would entail these charts rising above their 200-day moving averages and the dollar declining below 95.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

In TDG #679 we published an intro-report on an advanced exploration stage junior that has been off and on our watch list. It "ticks the boxes" but we were concerned the asset lacked potential. Upon a deeper look and based on some drill results in new areas, the asset could have significant potential.

The company has a market cap just over US $100 Million and based on the asset we think it could get to a $250M to $300M valuation fairly easily. We also discussed what needs to happen for the company to be valued in the $600M to $800M range. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. We do have lower entry points on everything but even from here, there are more than a few stocks with 10x potential over the next 3-4 years. And most continue to have 3x-5x potential over the next 18-24 months. Make sure you get into the best stocks with the most potential. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|