|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Now is Not The Time to Buy...

Published: Tue, 05/26/20

|

|

|

It has been a heck of a run for our sector over the past two months. Is it about to end? No, but we should lower our expectations for the days and weeks ahead.

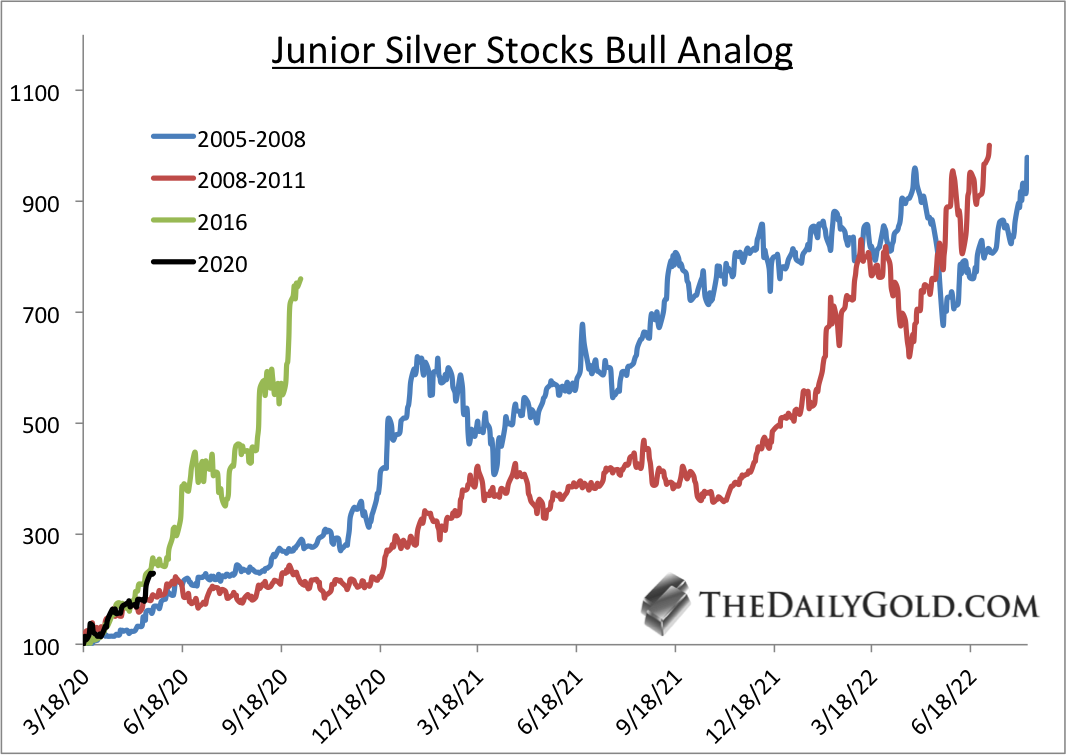

Click here to get my take on it. If you want the spoken word, then listen to this interview which was conducted a few days prior to the editorial. Moving on, take a look at this junior silver stock analog chart. We plot how a basket of junior silver stocks performed from mid 2005 to late 2007, from late 2008 to April 2011 and from the January 2016 low to its August 2016 peak. The black line is the current basket and the March low.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Since we last wrote to you, we published TDG #674 and TDG #675.

In TDG #674 we covered the silver sector and provided detailed thoughts on a number of different companies. The junior silver sector is in a totally different spot than in late 2008. There are very few pure silver companies as many are Gold & Silver and many juniors are base metals companies more so than silver companies. Another key difference is right now there are so few viable growth oriented producers. Also, many of the companies with the most upside have flaws. With all that said, look at the analog chart above. These juniors have some serious upside potential if we get into a full blown bull market for Silver, which has a history of rebounding close to 100% after major lows. In other words, it would not be out of the ordinary to see Silver trading at $24-$27 in 12-15 months. In TDG #674, we analyzed the return potential of some of these companies at $27 Silver. Subscribe and get our take on the junior silver sector and from TDG #675, you can get our potential buy targets on our favorite stocks. This will be very useful for you if we do correct here. Subscribe for Only $149

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|