|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Textbook Bullish Setups in Gold & Gold Stocks...

Published: Sun, 05/31/20

|

|

|

Last week we said it wasn't time to buy. The sector immediately corrected but then rebounded at the end of the week. Whether there is more correction ahead or the sector pushes higher, we need to keep this in mind...

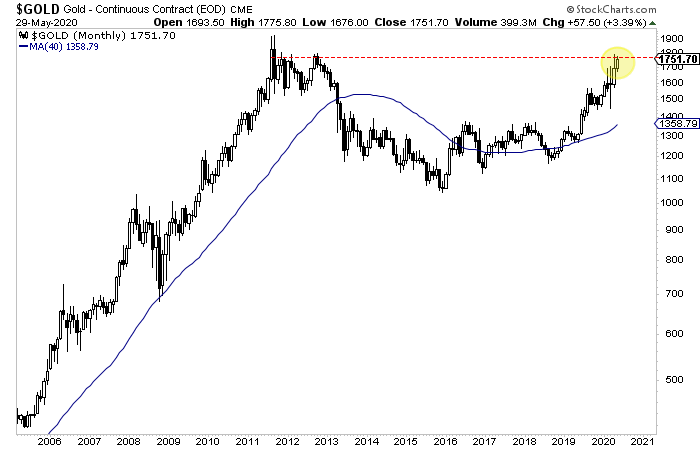

The larger setups in place and particularly in GDX and GDXJ have very bullish implications over the next 12 to 18 months. I did not mention Silver, but you are in luck. I just published this quick video update on Silver. Circling back to Gold, we see it has monthly resistance around $1755 and up to $1820 or so. It closed May only a few bucks from its second highest monthly close ever. Silver is outperforming now and perhaps it can reach $20 without Gold breaking past $1800. Maybe GDX and GDXJ continue to correct by going sideways as metals test strong resistance levels at $20 Silver and $1800 Gold?  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

In TDG #676 we analyzed some companies we do not own. We cannot own every company and we may miss some. Therefore, it is important to keep our eyes on some of these. The constant volatility in this sector will always create opportunity.

An ongoing correction can bring about another opportunity in high quality juniors. If we don't get that when we have to go lower on the quality food chain in an attempt to find something with a lot more upside. 2x to 3x upside in quality is great but something with lower quality that has 5x to 7x upside could be a better buy. We just have to make sure the flaw in those companies will be mitigated in a or by a bull market. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|