|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Upside Targets & Overbought Indicators...

Published: Tue, 07/21/20

|

|

|

Last week, I expected a correction. At least more than what we got. I told subscribers my guess of 7%-11%. My support targets were 11.5%.

GDX and GDXJ corrected only 6.5%! I was surprised. But not shocked. This is why I say buy and hold. I learned the hard way from my past mistakes. The most money will be made by buying and holding. To hear my latest thoughts and see some charts, take a look at this video published Saturday. Bear in mind, this analysis is subject to change as the market changes and we get new information. Next, take a listen to a 5 minute audio commentary. I share my thoughts on what types of companies will be the best performers moving forward, and what we need to look for to spot prospects.

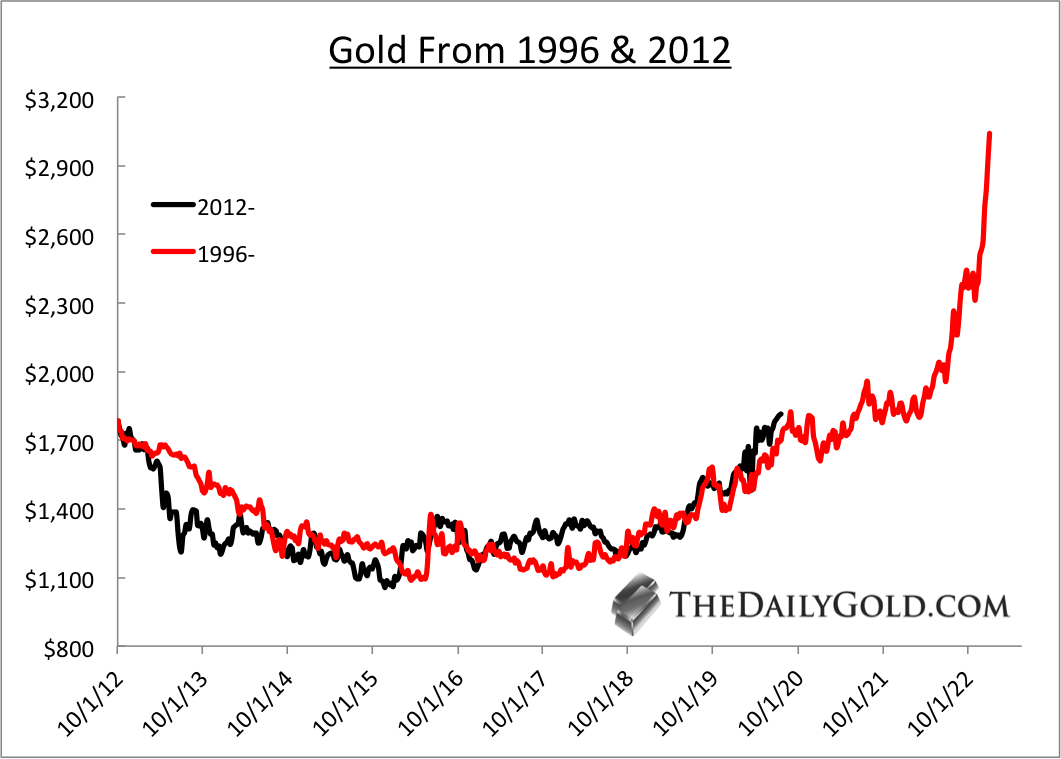

Moving along, take a look at this chart... This is what I think is the best comparison for Gold. The forever bear market is best compared to the bear market from the 1990s, not 1975-1976. Gold consolidated bullishly from 2004-2005 because there was a slight shift in the fundamentals then. The Fed started hiking. Thus, don't automatically assume Gold will repeat that consolidation over the next 18 months. These charts serve as a guide or a map. Not a prediction. I'd be okay with $3000 Gold in 2.5 years tho....  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Sunday AM we published TDG #683. The week prior TDG #682.

In TDG #682 we covered our holdings, the latest developments as well as their potential. In other words, "ABC Gold has 3x upside but potentially 4x." We are focused on a 2-year outlook and in some cases 3 years. This should be helpful to newbies because over 5-6 pages you can quickly get a sense of the potential of our holdings over the next few years. Then you can read the company reports later. (We didn't factor in our 12-18 month target of $2700, just $1800-$2000). As an aside, in TDG #674 we analyzed the junior silver sector, some of the companies and how they are valued. This past weekend we published TDG #683 which was a chart-heavy update. We charted all of our holdings and provided support/resistance levels in most cases. We also noted what one should do if they had too much cash. We mentioned the 2 best buys which corrected 20% to lows made just before last Fridays. Buy quality when it corrects. Buy value and especially so in lower quality things. I don't want to chase marginal companies or deposits. If you have to chase, go with the best and do it in small incremental buys. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. If we are lucky we find things with more than 5x potential and some of our stocks still have that potential. Make sure you get into the best stocks with the most potential. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|