|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Interim Peak in Gold & Silver Stocks...

Published: Mon, 08/10/20

|

|

|

I've been warning of correction risk for a few weeks now. Yes, I've been early. But that's why I (and you should) buy and hold in a bull market.

Since my initial warnings, the gold stocks hit very strong resistance levels with breadth indicators extremely overbought. As this occurred, the stocks lagged the metals badly. On Friday I wrote an article assessing the correction risk and potential support targets you should watch. If you prefer to watch the explanation on video, then check out my video analysis, published a few days prior. Speaking of videos, I give my analysis of where Silver could peak during the current bull cycle.

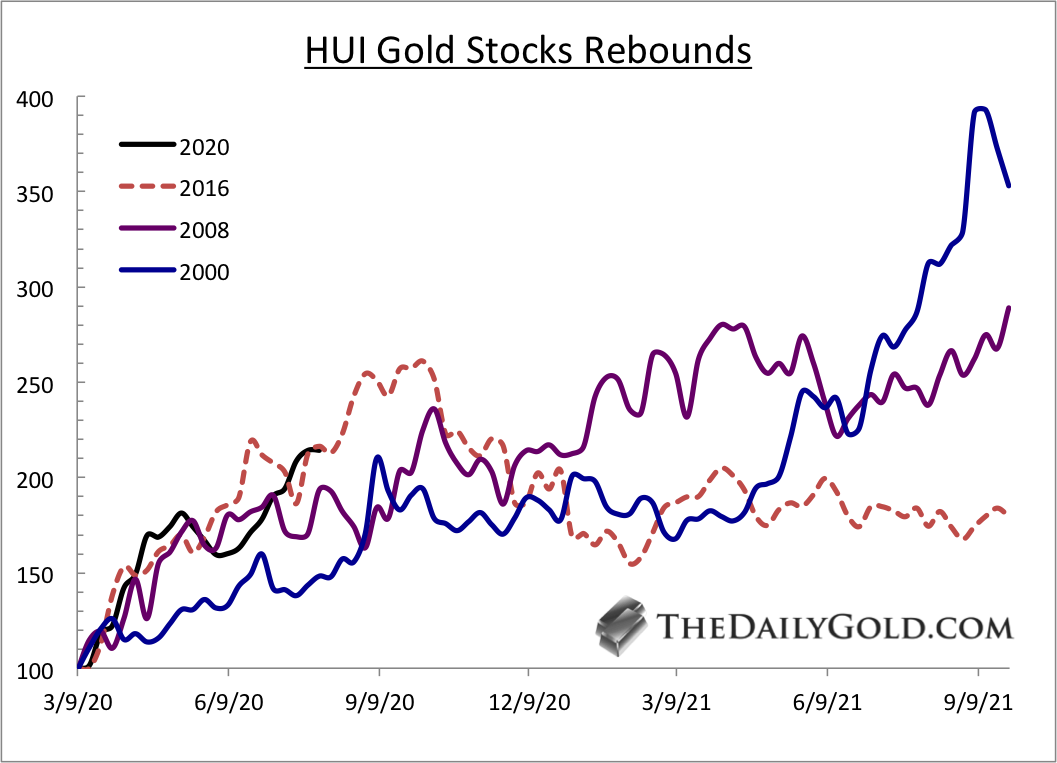

Moving along, here is an updated look at how the rebound compares to those of the past. If the gold stocks kept going they would align with the 2016 run. I think they will correct and come back in line with the 2008-2009 rebound. That comparison calls for a 2-month correction now.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

I have published several premium updates since my last email to you.

In TDG #685, I spent four pages analyzing junior silver stocks. The last silver-specific update I did was TDG #674. On the first page of the four, I listed 16 silver stocks in a table, their market cap, their ounces of silver, the silver grade, the silver-equivalent grade and the silver equivalent ounces. The table allows you to see how these stocks are valued and how they compare to each other. In the update I discuss the important criteria we should use to look for silver plays. There is only one growth-oriented producer in my opinion and so everything else is an optionality play or an exploration play. In Sunday's TDG #686, a 27-page update, I charted all of our stocks and put forth support targets which in most cases are good entry points. A week ago I published a Macro-Market and Precious Metals report which was a condensed update of my 2019 book. The report focuses on the secular outlook going forward and the outlook for the current cycle in precious metals. I assess how long this cycle could last. By subscribing you could get access to all this immediately, plus a lot more and another 6 months worth of updates. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. If we are lucky we find things with more than 5x potential and some of our stocks still have that potential. Make sure you get into the best stocks with the most potential. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|