|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Breakout Not Confirmed Yet...

Published: Tue, 06/30/20

|

|

|

If you are reading this on Tuesday, then note that a close above $1774 in Gold marks the end of the quarter and that would be the highest quarterly close ever.

But Gold still has big resistance at $1800. And Silver has at $18.50. GDXJ is testing 7-year resistance. Until these levels give way, there is no sector breakout, officially.

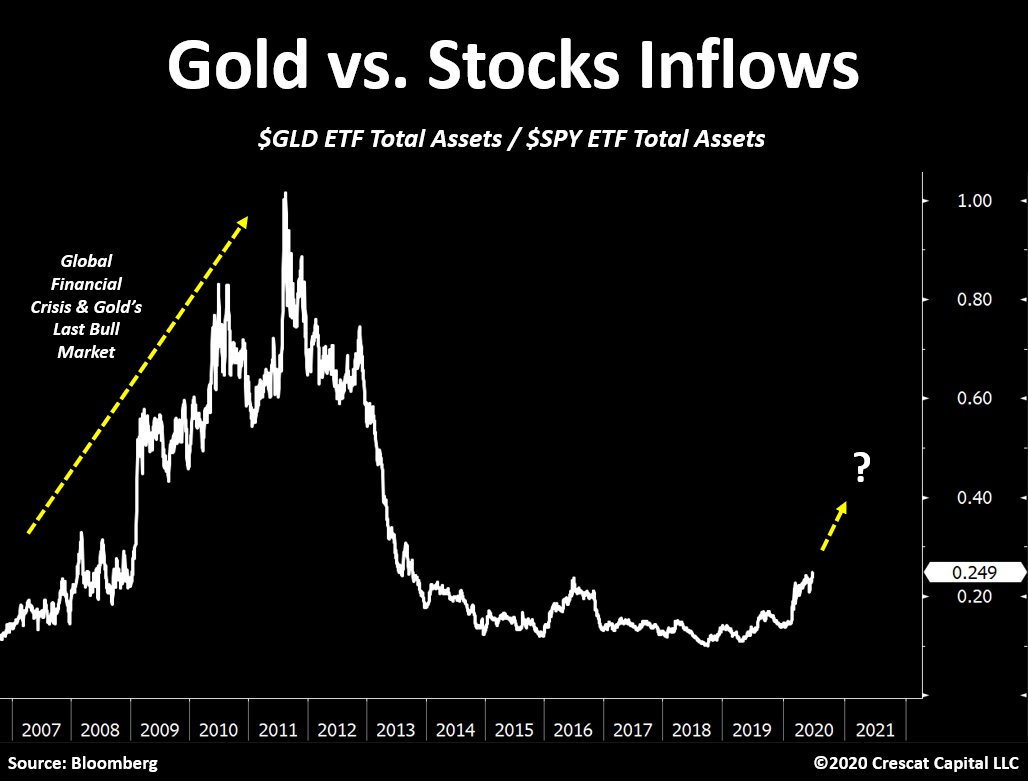

Moving along, take a look at these two charts... First, this is flows into GLD versus flows into SPY. This is an excellent sentiment indicator. Its starting to breakout from a 7-year base. Plenty of room for this trend to continue! The bull market is just getting going!  Here is a mystery chart.... In TDG #680, I noted this could be the most important chart to follow now. When this breaks that red line, precious metals could accelerate.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

In TDG #680 we highlighted a certain development company for the first time. It has potential to produce 200K oz Au/yr at reasonable costs and the capex is not too onerous considering existing infrastructure and use of a "hub and spoke" type of model.

Simply put, if this company executes it can be a 5-bagger stock over the next 2 years. If Gold moves past $2000/oz and the company executes, it has 7 to 8-bagger potential. The stock is not too overbought and has enough liquidity to ensure a reasonable entry price. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. I'm very happy when I find something that has more than 5x potential. I'm working hard to find more. Make sure you get into the best stocks with the most potential. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|