|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Stock Correction Continues...

Published: Mon, 09/14/20

|

|

|

Precious Metals will continue to correct in time and also probably in price.

Read why here. For those who prefer the spoken word, here is an interview I did with Mining Stock Education. We discussed among other things, silver juniors, how technical analysis can be useful and why you should be skeptical (but not a cynic) on various claims by people and companies in the industry. For more thoughts on the sector, trimming strategies, how to handle new companies, etc. Click Here for my interview with Cory Fleck. You offer such an excellent subscription service. In my opinion, your analysis is so sophisticated and accurate, but yet it is very simple to follow and learn from. Jordan has been way more accurate than most metals analysts and the people who pretend to be analysts.

I have tried quite some subscription over the years and yours has been best of all hands down.

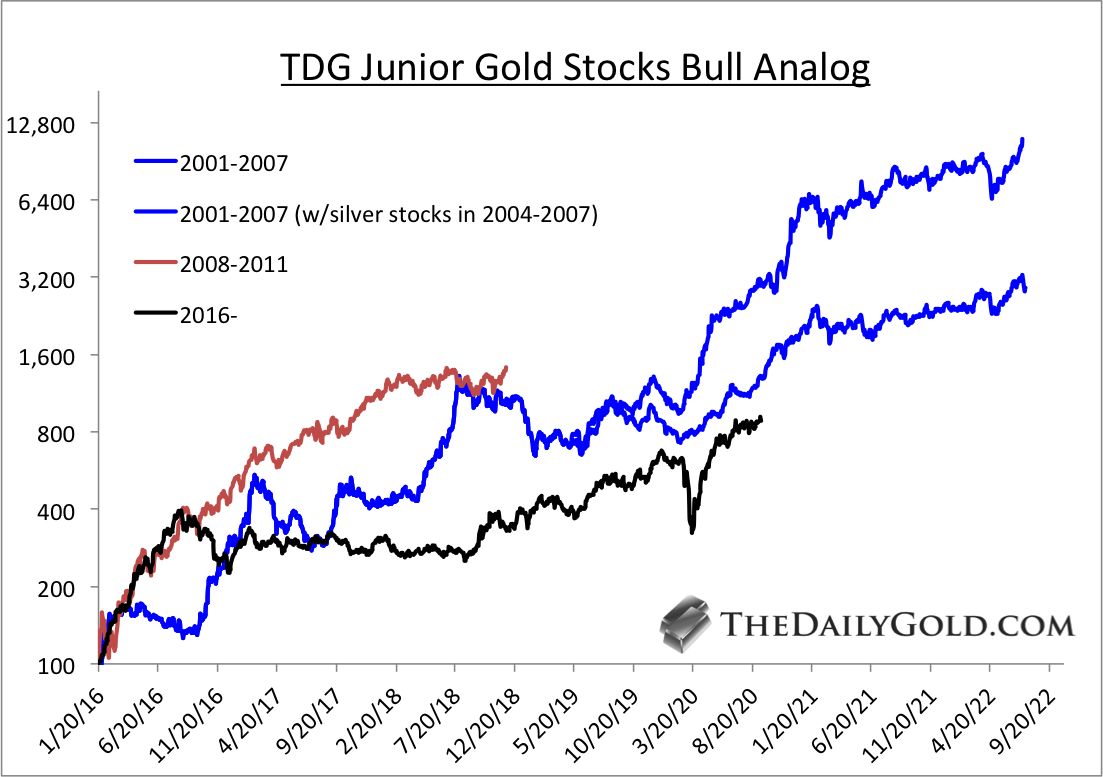

Moving along, here is an updated analog chart for junior gold stocks. This is a basket of strong performing stocks. I don't think it compares well with 2001-2007 or 2008-2011 due to the long pause after 2016 but it cannot hurt to take a look. My guess is this cycle has a minimum of 3 more years to run and probably 4.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Last week we published TDG #690, in which we assessed the potential upside of all of our holdings. (The potential changes based on performance and company developments). This is something we do every few months. We asses potential based on a 2-year outlook (and 2-3 years for producers).

In TDG #691 we updated our watch list and now use two tiers. If I am right and this correction has more to go, then there will be good entry points coming over the weeks ahead. It's not time to buy yet but it likely will be soon enough. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. Signup and download TDG #690 and our company reports immediately to get a sense of their upside potential. Make sure you get into the best stocks with the most potential. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|