|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Ratio Charts Implications for 2021 & Note on Silver...

Published: Tue, 09/01/20

|

|

|

Ratio charts involving GDX (gold stocks), Gold and the S&P 500 are poised for potential huge breakouts in 2021.

If such a breakout comes to pass, what would it mean for 2021 and beyond? Click Here to find out & view the ratio charts If you prefer the video version and the spoken word, click here. Before I get to Silver, go to Steve Saville's Blog and read the last two posts. I was only going to link one but the first two are excellent. These concern Fed Policy & US$ Weakness and the implications for the economy and markets. You offer such an excellent subscription service. In my opinion, your analysis is so sophisticated and accurate, but yet it is very simple to follow and learn from. Jordan has been way more accurate than most metals analysts and the people who pretend to be analysts.

I have tried quite some subscription over the years and yours has been best of all hands down.

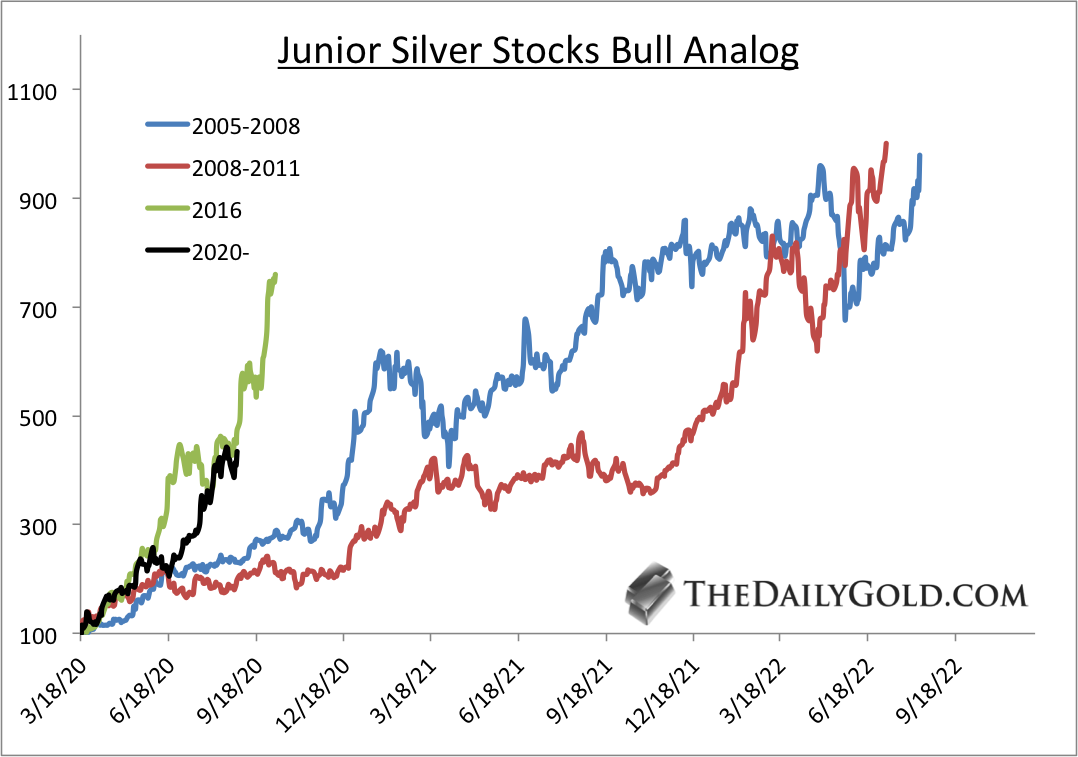

Moving along, here are a few comments on Silver as well as a chart. The daily silver chart looks strong but the stocks are still lagging a bit. With that said, I'm skeptical this move is sustainable in the short-term. If you have huge gains in junior silver stocks, consider trimming those positions. There are some stocks that have made extreme moves considering their current value. I don't see that in any of our silver stocks though I did trim one recently.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

I’ve been reading JRB for over 12 years and a subscriber for 2 years. Excellent, outstanding honest service, best investment newsletter I’ve ever made (and I’ve been through many). My only regret is not being more patient and listening to JRB more closely!

Sunday AM we published TDG #689, a 23-page update. We published a flash update a few days prior.

This is a tricky point if you are have too much cash and you are waiting to buy. The correction thus far has been too mild in price. The 2008-2009 analog does argue for more short-term strength but then another leg down before the correction/consolidation runs its course. I discussed how to deal with the balance between waiting for more correction and FOMO (fear of missing out). You can buy half positions. You can eliminate (don't buy) things that have gone vertical in the past month. You can buy quality that has corrected the most. (The two stocks on our watch list meet that criteria). If something is down only 10%-12% but you intended to buy at 20%, you can buy a half position. That's especially prudent if its a best of breed type of company. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. If we are lucky we find companies with more than 5x potential and a few of our stocks still have that potential. Make sure you get into the best stocks with the most potential. The next few weeks should provide a decent entry point. I look forward to helping you make money. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|