|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: An Update on the Correction in Gold & GDX...

Published: Thu, 10/15/20

|

|

|

Here's the update on the correction.

It's still happening. Whether it be in price or time, or both, I expect it to continue. At the least, I don't advise investing based on the belief some kind of breakout is imminent. Here is my latest article: Prepare for Coming Opportunity. For a bit more on short-term technicals and the like, here is yesterday's audio interview with KeReport. And, there is a lot of noise out there right now and paying attention to it can affect your investing results. As an investor, you should ignore the noise and focus on other things. Listen to my thoughts here.

I have also subscribed to 3 other newsletters, but up to this point, yours is the BEST! The other writers don't give enough good, solid reasons why I should buy their recommendations. The 2 things I ABSOLUTELY LOVE about your updates are the technical analysis of support and resistance. And the possible upside and downside of each pick. I need SOLID reasons why I should consider buying something. Great work Jordon. You’re the best in your space probably the best in all PMs

Jordan has been way more accurate than most metals analysts and the people who pretend to be analysts.

I have tried quite some subscription over the years and yours has been best of all hands down.

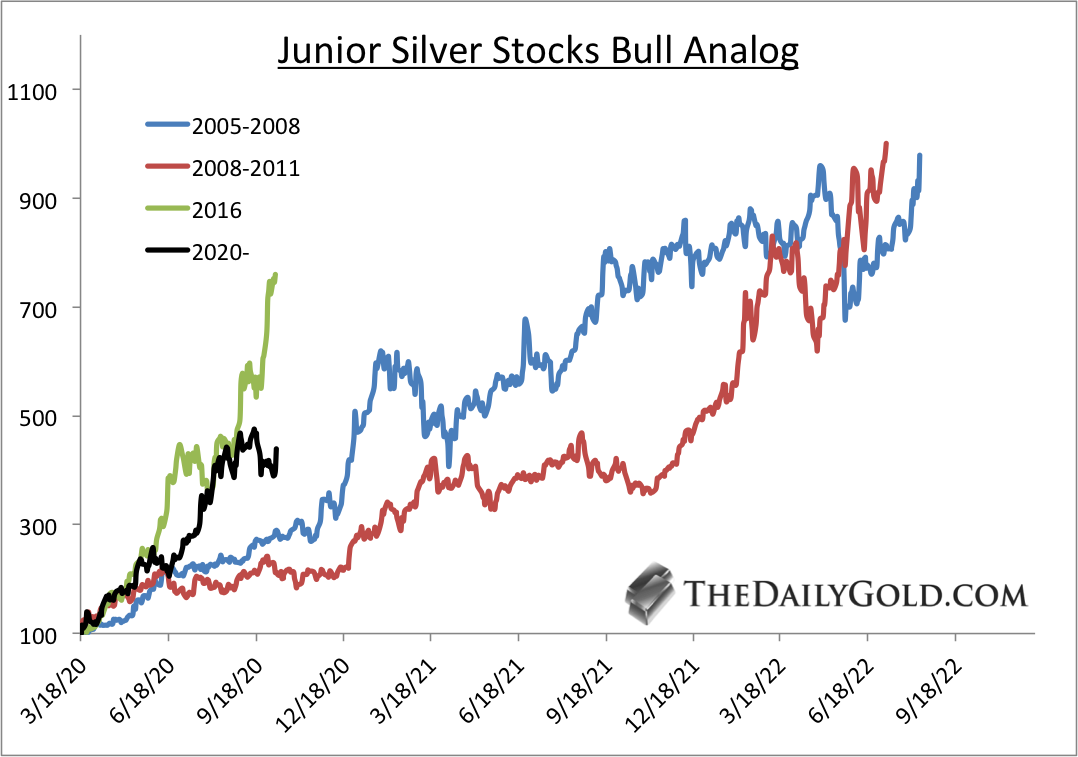

Moving along, here is an updated chart of the junior silver stocks analog. This is a basket of 9 companies. The current move is in black. I would not be a buyer of junior silver stocks here. There needs to be more correction.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

In TDG #694 published Sunday, I opined on how I would start a brand new portfolio today. I noted which stocks I would buy and at specific prices. This included two stock from our watch list. As I adjust my own portfolio I will continue to advise and guide those who are starting fresh or want to make more changes.

Speaking of watch list, a few weeks ago we noted one of the cheapest optionality plays and added it to our watch list. Only days ago the stock partnered with a major and now the stock is up over 100% since we mentioned it. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. I want to help you by finding companies with the best combination of fundamentals and upside potential. If I'm right and the correction continues, there will be another buying opportunity in the next month or two. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|