|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Outlook for Gold Stocks Post 2020 Election...

Published: Mon, 11/09/20

|

|

|

Was the election gap up (that's what I'm calling it) the start of the next launch higher in the precious metals sector?

I don't know. Nobody knows. But I do have some thoughts. Read about my take here. Days prior to the election, I published a video analyzing sentiment indicators in the sector. You can view that here.

I have tried quite some subscription over the years and yours has been best of all hands down.

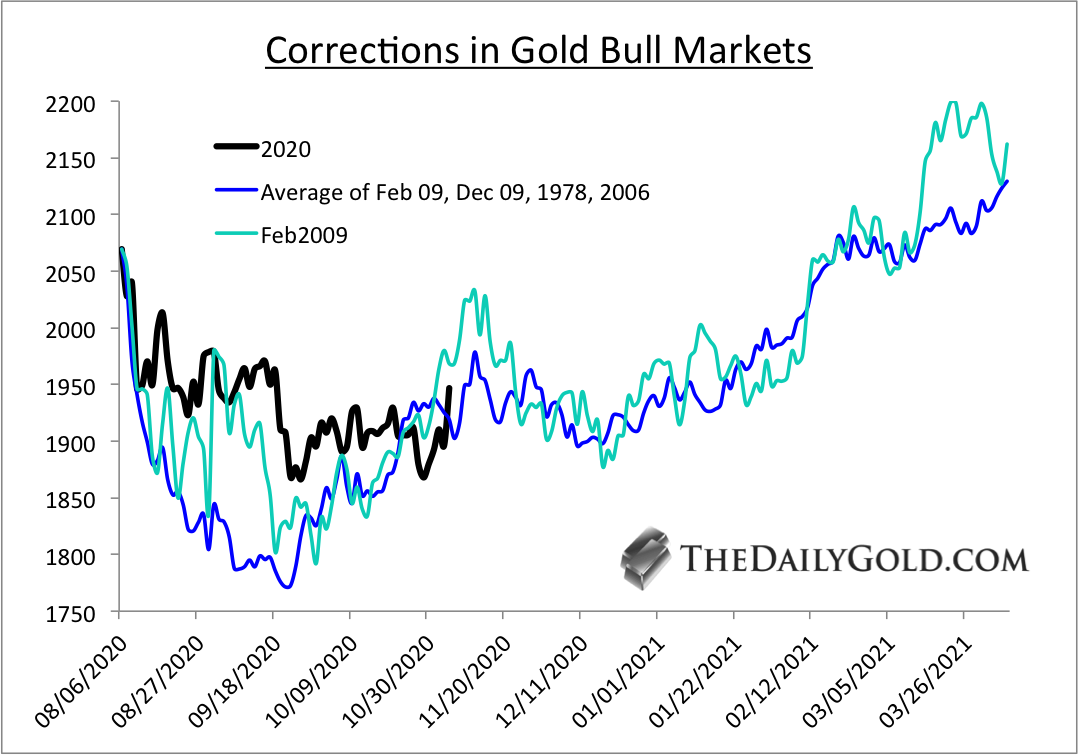

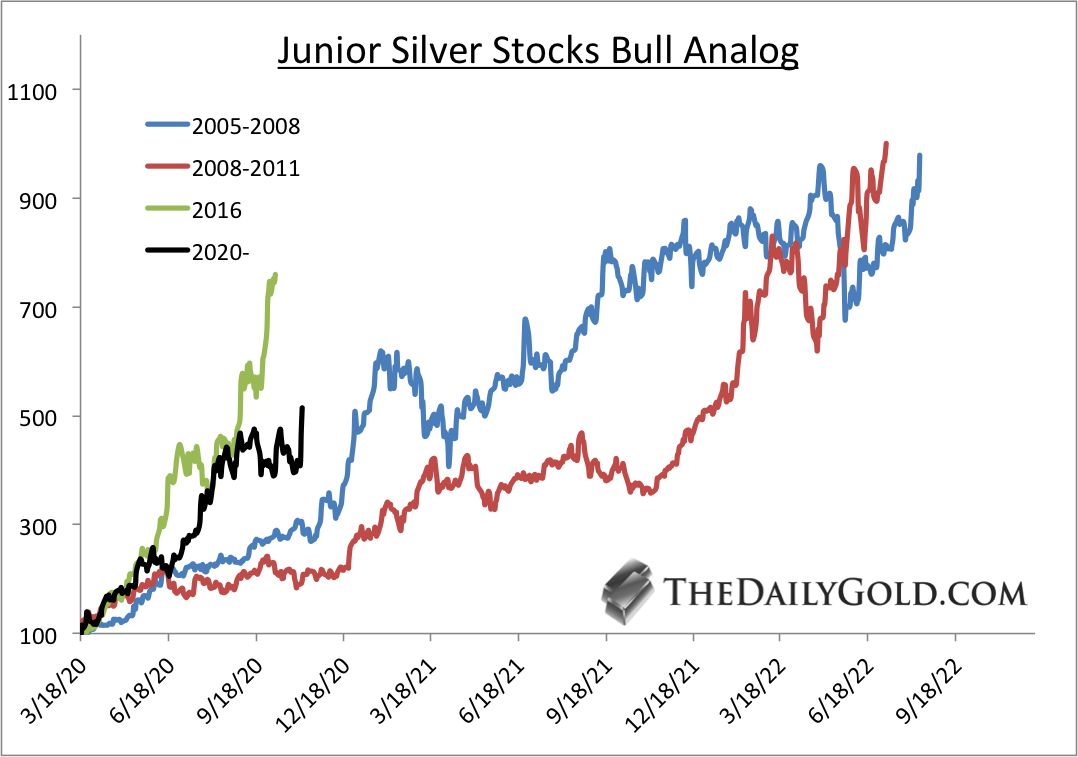

Moving along, here is a new analog chart. This chart compares the current correction in Gold with those from the past, that in my opinion share similarities.  Here is an updated look at the silver stocks bull analog. The current index (black) contains 9 silver juniors. I own some of these. Tell me your thoughts. Is it too overbought? More consolidation? Or is this a real breakout in a handful of silver stocks?  Moving onto TheDailyGold Premium... I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

In TDG #698 we included an updated report on one of our favorite silver juniors. There aren't many silver juniors so I'll spare you the hints. In the previous two weeks we wrote reports on two companies we think have 5-bagger potential, and perhaps 7-10 bagger potential if Gold goes to $2500 in 2-3 years.

In TDG #699, in Q&A we answered a question about a newer silver company. As part of my TDG Elite service, we participated in financing this company. It has a chance to emerge as the best optionality play in Silver. Also in TDG #699 we also updated buy price targets on a number of our stocks. Specifically, these are the stocks we'd buy if we were starting a brand new portfolio. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. I want to help you by 1) finding companies with the best combination of fundamentals and upside potential and 2) buying them at the right time. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|