|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: This Chart Signals When Gold Stocks Will Explode...

Published: Mon, 11/16/20

|

|

|

I could post the chart here but then you wouldn't read my article.

Read my article. It's here, and so is the chart. For my immediate technical analysis, take a listen to this video. It was published after Wednesday and still relevant. I explain why gold stocks could be approaching a buy opportunity. Do not fear Africa. There are some good jurisdictions there and plenty of major and mid-tier companies have operations in the region. In this video I discuss the reasons why Africa is great for gold mining and gold exploration.

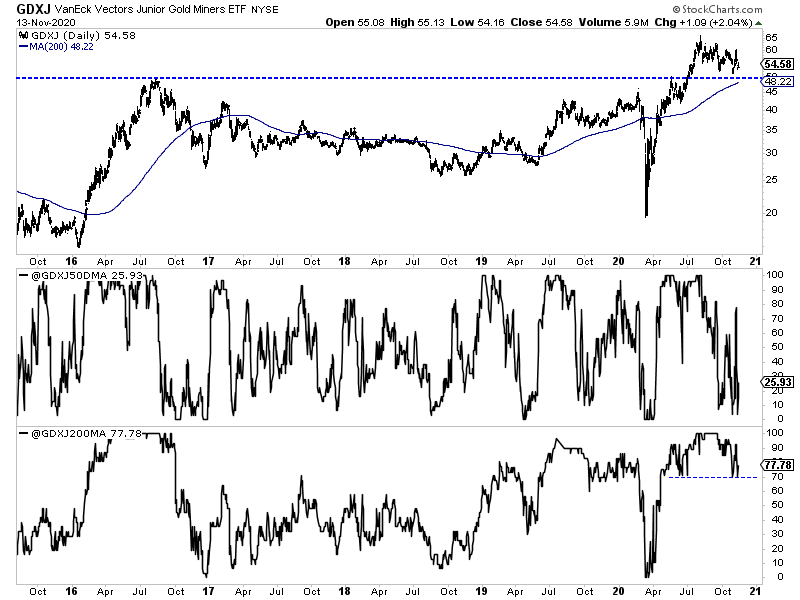

Moving along, here is a chart of GDXJ w/ the percentage of GDXJ stocks that closed above the 50-dma and 200-dma. There is now very strong support at $49. Roughly 26% of GDXJ stocks closed above the 50-dma with 78% closing above the 200-dma. I've been telling subscribers I want to see that figure drop. If and when it does it could coincide with a test of $50.  Moving onto TheDailyGold Premium... I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

In TDG #700 we included a report on a watch list company and among other things, commented on how the layman can evaluate drill results.

The watch list company is an exploration company that has a good chance to be a 3 or 4 bagger in the next 12-18 months and maybe a 5-bagger if things go right. The company has a good chance to drill out +3M oz Au. If it gets close to 5M oz then it could be a 5-bagger. The project has tier-1 potential and the stock put in a strong base and is starting to emerge. The company will have strong news flow over the weeks and months ahead. And it's a liquid stock. In Q&A I responded to a question about a particular fund and geologist hyping a stock. A week prior I said the stock had become too hot. If it's too hot you either hold or trim. This stock became too large a position recently so I trimmed it. (I may do an audio commentary about how to buy a stock that is running hot). Let's not make this rocket science. Buy and hold. Cut losers. Trim your big winners and then allocate that cash into something with a more promising immediate outlook..like the company I covered in TDG #700. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|