|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Be Prepared for the Coming Buying Opportunity...

Published: Tue, 10/06/20

|

|

|

When and from where (in GDX, GDXJ) is the next buying opportunity?

I share some thoughts in this video analysis. I've been thinking more about developers and which ones I'm interested in. In this video I analyze three key criteria that makes an ideal developer which has more than typical upside. Elsewhere, Steve Saville, explains why fundamentals for gold miners remain bullish.

I have also subscribed to 3 other newsletters, but up to this point, yours is the BEST! The other writers don't give enough good, solid reasons why I should buy their recommendations. The 2 things I ABSOLUTELY LOVE about your updates are the technical analysis of support and resistance. And the possible upside and downside of each pick. I need SOLID reasons why I should consider buying something. Great work Jordon. You’re the best in your space probably the best in all PMs

Jordan has been way more accurate than most metals analysts and the people who pretend to be analysts.

I have tried quite some subscription over the years and yours has been best of all hands down.

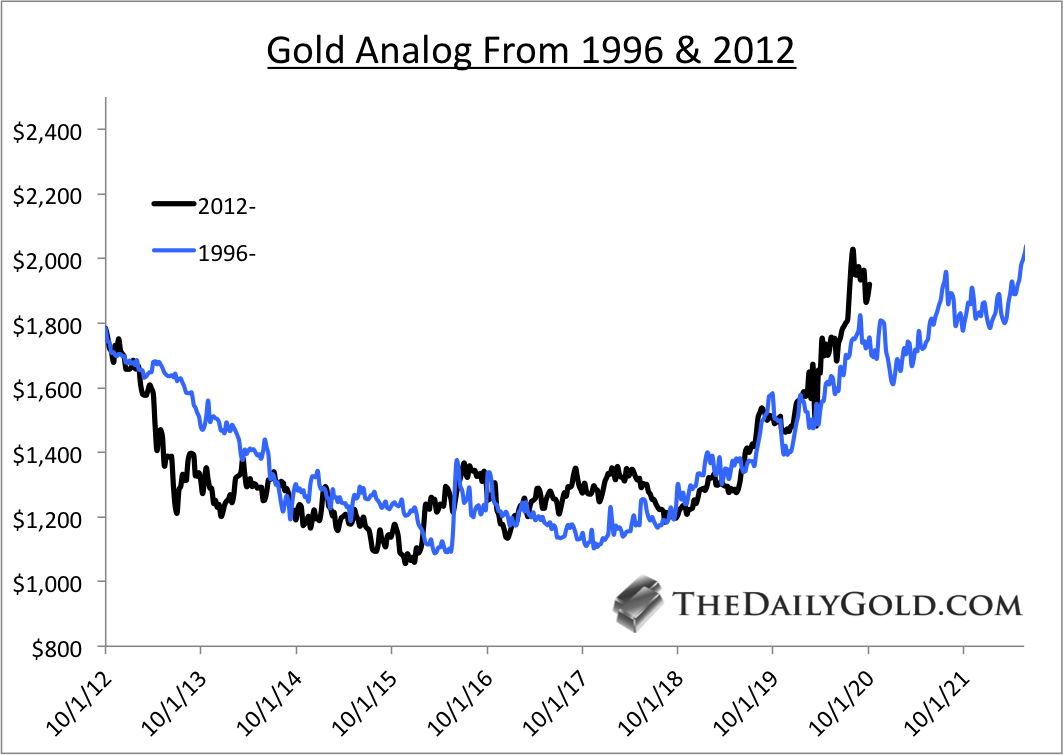

Moving along, here is an updated chart of one Gold bull analog. This compares Gold's performance following the 1996-2000 bear and 2011-2015 bear. The chart ends at the start of 2022. It doesn't show January 2023 when the analog shows $3000 Gold. That's only 2+ years from today.  Moving onto TheDailyGold Premium...

I have seen and tried a few of the news letters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks they are all low risk minimal downside with huge upside. I have found some of the other news letters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

In TDG #693 we provided buy targets for our companies, comments on development & optionality plays and we added a new company to our tier 2 watch list. It could be an optionality type of play with a future US listing, very tight structure and 5-bagger potential.

With respect to development plays, we commented on which companies fit the criteria we are looking for. You can review our criteria in the aforementioned video. Essentially, to break it down, we are looking for growth potential that can be financed. I also discussed the advantage that new optionality plays have over existing ones. My goal is for us to invest in things with 3x to 5x potential over the next 18 to 24 months. Make sure you get into the best stocks with the most potential. We could see some very good entry points coming this month. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|