|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Gold Stocks Grinding Out a Bottom...

Published: Tue, 12/15/20

|

|

|

I have some great content for you this week.....

Just penned a little while ago, is my latest take on the sector. It appears to me that gold stocks & Gold could be grinding out a bottom. Last week I did an interview with Mining Stock Education, which focused on my views on developers, sentiment & potential concerns for Gold going into 2021. Click here to see it. Finally, sentiment on the stock market is off the charts. A talk of a crash is making the rounds again (as it often does in the gold world). In this video, I explain the timing of the next major bear market in stocks and what will cause it. Attention high net worth investors..... If you have at least US $1 Million invested in precious metals and are interested in private placements and consulting, then you may be interested in TheDailyGold Elite. My next two private placement opportunities are in two silver companies and these could be two of our best deals over the next 12 months. If you meet the criteria and have immediate interest, let me know. I have space for a few more members.

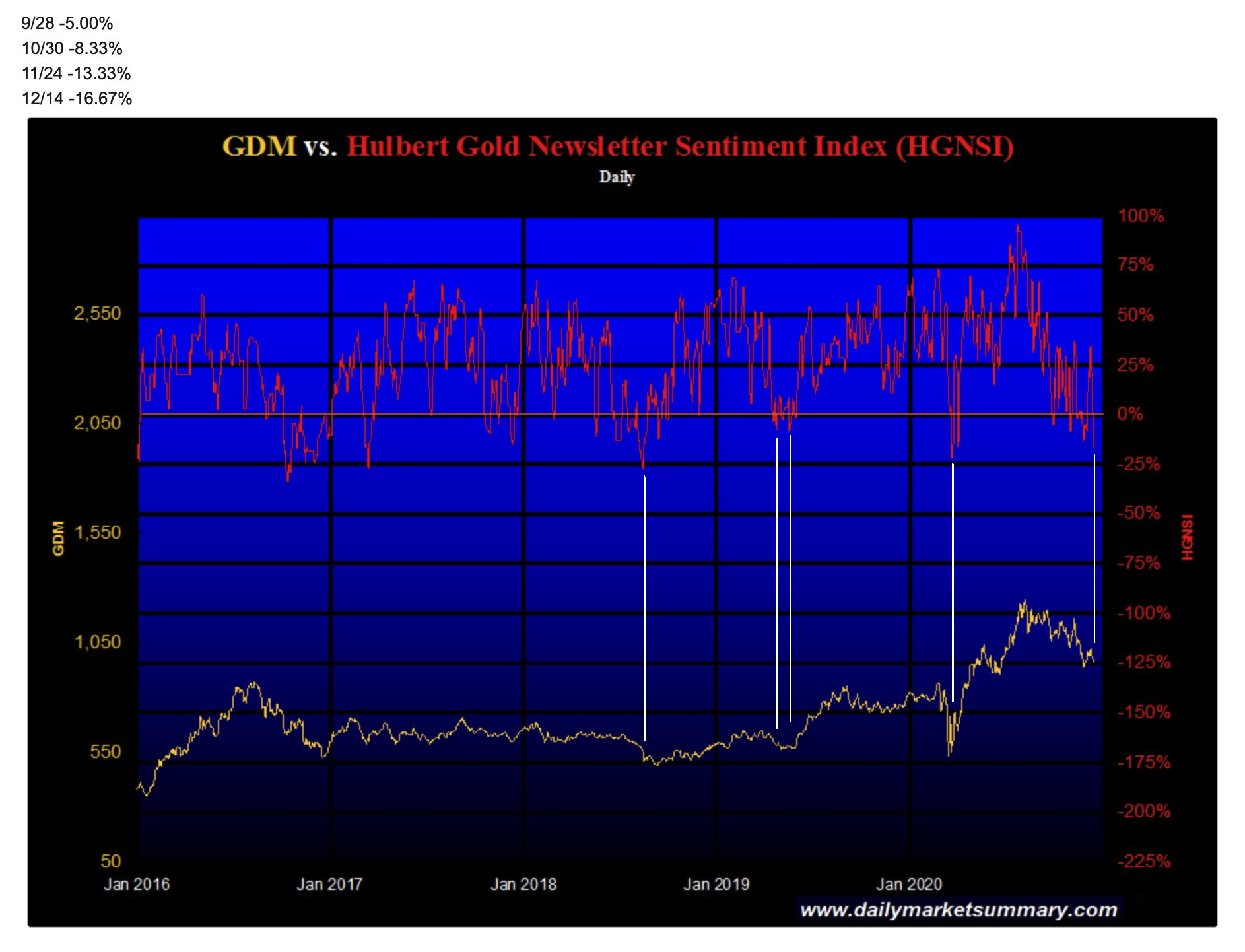

I grabbed this chart from Twitter. The HGNSI is a sentiment indicator for Gold. This chart is from Lance Lewis @lancejlewis. This chart plots the indicator (top) with GDX (bottom). The white lines are mine. I marked most but not all of the oversold readings of the past 3 years.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

TDG #704 focused less on sector technicals and more on subscriber Q&A, sentiment indicators, technicals on individual stocks & a new watch list company. Here is part of my update summary: When I look at the technicals of our stocks I see a mixed picture. Some are in a bullish consolidation that will continue. Some are oversold and should bottom soon and bounce with the sector. Someone asked which stocks might perform best over the next 6 months. My guess right now would be the [redacted]. They have the right chart patterns and could trend higher after [redacted]. The new watch list company is another case of how exploration can impact producers. This junior producer is poised for significant production growth over the next few years. Exploration at its second project has been quite successful and the market is missing the potential. This company could be a 4-5 bagger over the next 2-3 years. I'm afraid it might be taken out too soon. I’ll keep this quick as I’m sure you’re busy right about now! First off, GREAT JOB with your calls recently! I feel much more confident navigating my gold investing with you in my corner! Also, I really appreciate the “buy, hold, accumulate” rating in your newsletter.

That is very helpful for me.

Thanks much sir. You are calling this great so far. Better than all others and will get credit.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|