|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: How to Spot 10-Bagger Developers...

Published: Thu, 12/24/20

|

|

|

I talked about developer plays in an interview last week. I put a few thoughts down on paper. Read here about finding those 10-baggers.

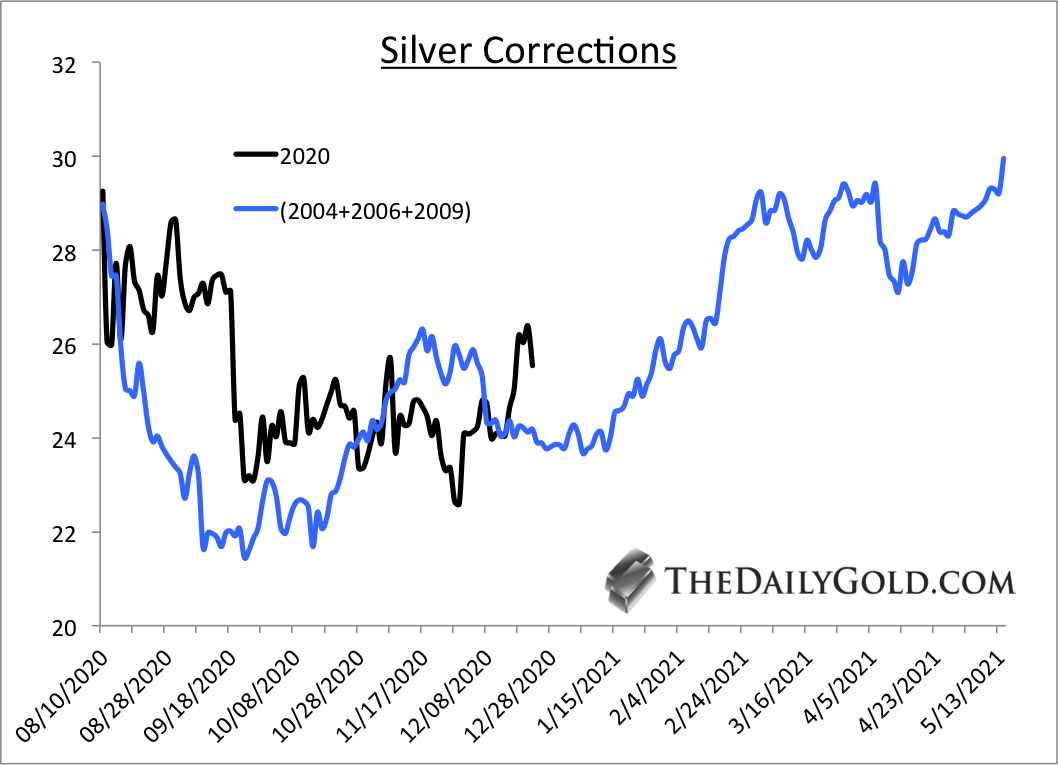

This sentiment analysis is a week old but it remains actionable. I discussed current sentiment for Gold & Silver and concluded that while the net spec positions are not super low, there is enough room for more specs to come in & metals could at somepoint retest the August 2020 highs. Speaking of 10-Baggers, I finally recorded a new 10-Bagger Podcast. For episode 18, I invited the Uranium Insider back for a second time. Uranium stocks are moving! Justin Huhn is one of the very few guys with a uranium newsletter and he does a great job. Click Here for the interview. Check out his website here. Here is a chart comparing the current correction in Silver to those in 2004, 2006 and 2009. The correction analog for Gold is much cleaner. This analog argues Silver could retest its high ($29-$30) in the spring. The key resistance level is $26. Silver needs to make a few weekly closes above $26.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #705, we added another development company to one of our watch lists. It's likely 2 years from construction so we could be a bit early. Nevertheless, the company has a market cap barely over $100 Million and one analyst projected their pre-feasibility study could show a $1 Billion NPV at $2000 Gold. I'm researching another earlier stage development company. It has a growing asset, an economic study, two seasoned executives (on the board) with a track record and it has a market cap below US $50 Million. This will be covered in TDG #706. There is still value to be found in this sector and I'm looking everywhere and talking to my contacts in order to leave no stone unturned. The model portfolio as of Monday was within 1% of its all-time high. Trim big winners, cut the laggards and redeploy that capital into better ideas. I can help you do that, while getting you invested in the stocks with the best fundamentals and potential. I’ll keep this quick as I’m sure you’re busy right about now! First off, GREAT JOB with your calls recently! I feel much more confident navigating my gold investing with you in my corner! Also, I really appreciate the “buy, hold, accumulate” rating in your newsletter.

That is very helpful for me.

Thanks much sir. You are calling this great so far. Better than all others and will get credit.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|