|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Will Gold & Silver Go Vertical in 2021?...

Published: Mon, 01/04/21

|

|

|

Precious Metals have rebounded and in the overnight session (as I pen this Sunday evening) are pushing higher again.

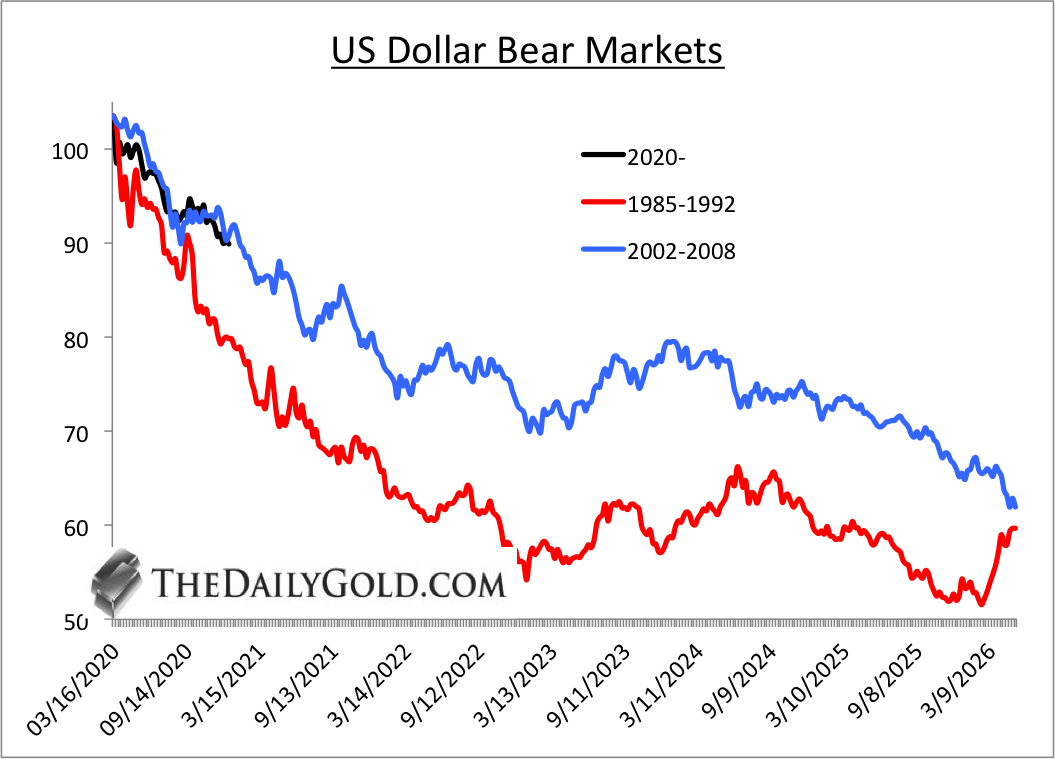

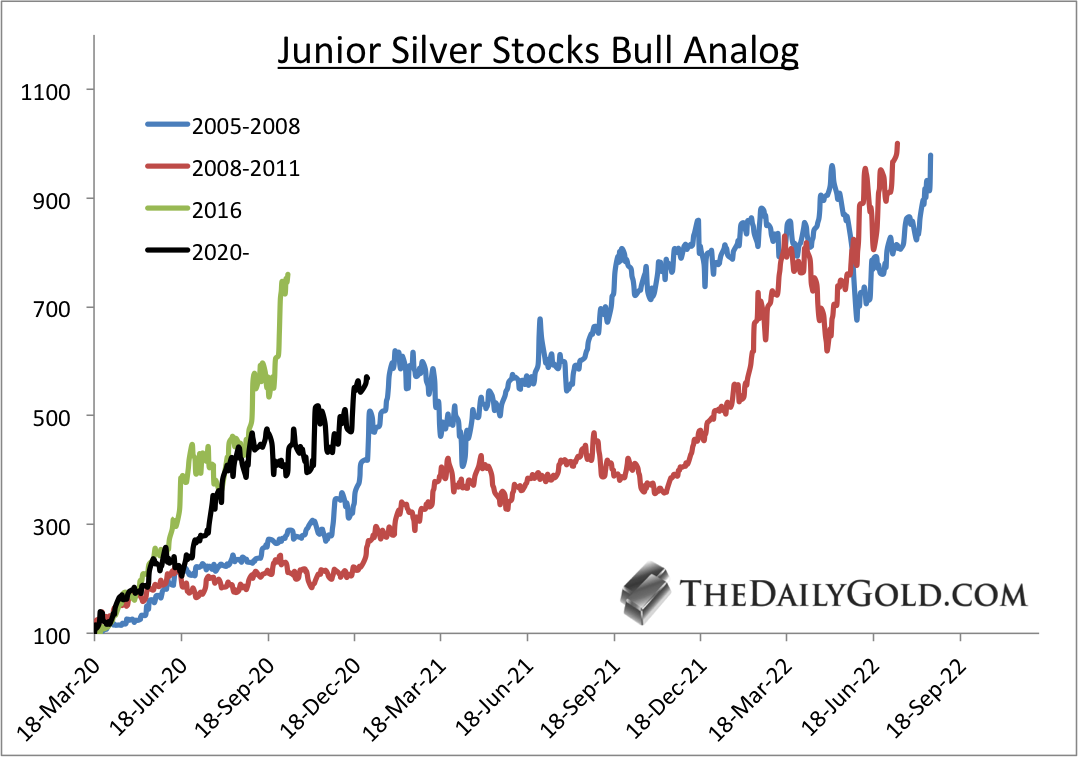

Could we see another vertical move like we saw in spring and summer of 2020? What are the key resistance levels to watch? I evaluate the potential in this article, published Friday. A few days before I wrote that article, I was interviewed by Cory Fleck and the KEReport. I shared my thoughts on Silver & silver stocks. First, a compliment. I so appreciate your well researched, thoughtful reflection with specific, clear stocks that have 5 bagger potential. You make it look easy (with only hundreds of hours of research) to find great opportunities. Here is a brand new chart. Just published hours ago. I plot the bear markets in the dollar index. (Unfortunately I don't have data for the 1969-1979 one). Look at how closely the dollar is following the 2002-2008 bear! But be mindful of major support at 88 and current bearish sentiment.  Here is an updated look at my junior silver stocks bull analog. The current run (9-stock index) is in black. Would you buy that chart now?  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #706, published 8 days ago, we included an intro report on a company that we've described as having 10-bagger potential over the next 3 years. The stock has popped, but not because of our buying it. It has broken a key technical level. If I give you hints you might guess it. Ok fine. It has a very successful management team and is backed by some of the biggest names in the industry. But that's all I will say. In TDG #706 we also covered a company which we added to our watch list. The current enterprise value of the company is below US $40 Million. It has some very successful people involved. One is a gentlemen who took a previous company from a $0.05 share price to as high as $1.50 and he sees some similarities in this new venture. The model portfolio closed 2020 at a new all time high. Most of our holdings have performed quite well over the last month. The key for 2020 is I stopped trying to trade and focused more on stock selection. The most money is made by buying and holding during a bull market. Focus on picking the best stocks and then be pragmatic about managing your portfolio. Cut losers and trim big winners (by selling 1/3 or 1/2) along the way. I'm not satisfied with what I own or have found. I'm going to continue to try and find the future 5 and 10-baggers that have not moved yet. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|