|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Are Gold & Silver Headed for Bigger Correction...?

Published: Thu, 01/14/21

|

|

|

Precious Metals put in a nasty reversal at resistance last week. I expect $1960 and $27-$28 will hold up as resistance into the spring.

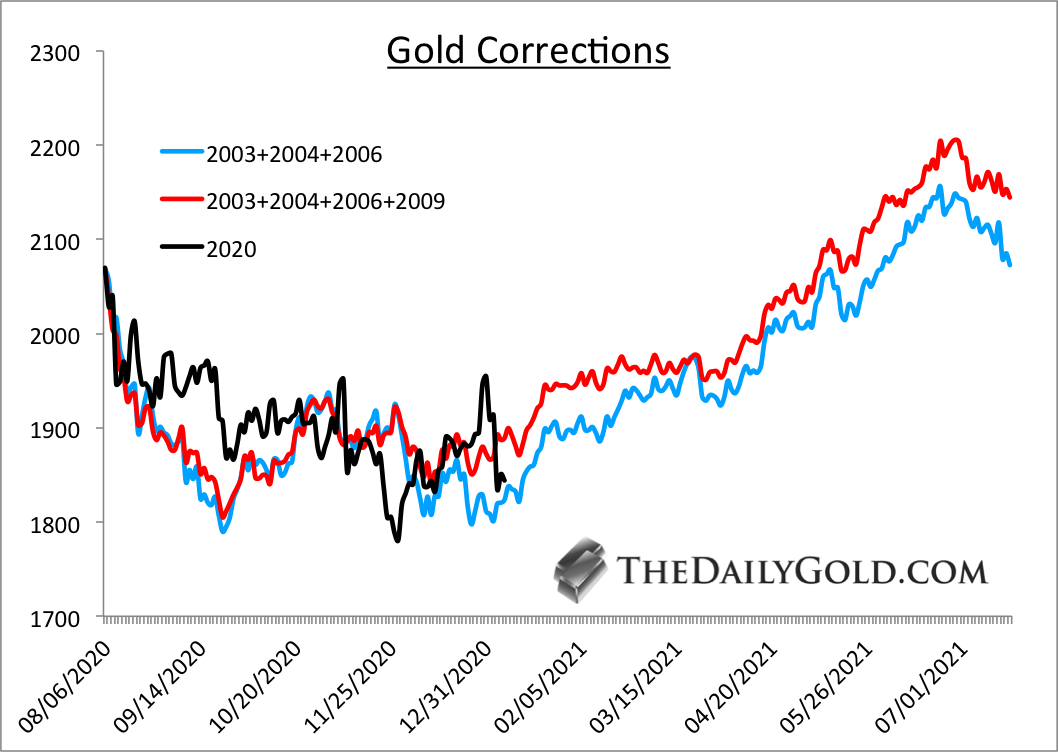

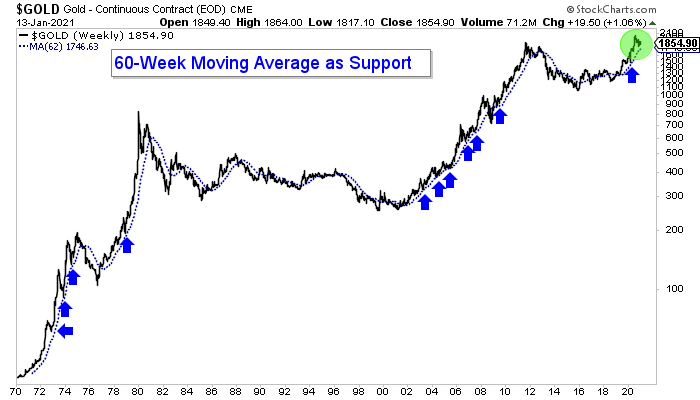

It's too soon to project the next low. We don't have enough information yet. However, I do note various support levels in this article. Yesterday I did an interview with Cory Fleck. We discussed the key levels in Gold & GDX, among other things. Last week I discussed the outlook in 2021 with Mike Swanson, what has to happen for a vertical move and sentiment. First, a compliment. I so appreciate your well researched, thoughtful reflection with specific, clear stocks that have 5 bagger potential. You make it look easy (with only hundreds of hours of research) to find great opportunities. Here is an updated correction analog chart. I plot the corrections that began from peaks that shared a similarity to the August 2020 peak (in Gold). These corrections, on average, lasted 5-6 months and typically did not make a new low at the end of the correction.  Here is a weekly line chart of Gold with the equivalent to the 300-day moving average. Call it the 62-week moving average. This moving average has provided support during numerous corrections during the bulls in the 1970s and 2000s. The 300-day moving average is at $1743 and rising. The November tick low in Gold was $1767.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #707 we focused on the technical outlook for the sector, as well as for our stocks. We noted that, roughly speaking, our gold stocks may have 10-15% downside but that the silver stocks had more downside. We have trimmed two of our silver stocks twice in the past few months. As I wrote last week, the most money is made by buying and holding during a bull market. Focus on picking the best stocks and then be pragmatic about managing your portfolio. Cut losers and trim big winners (by selling 1/3 or 1/2) along the way. This type of strategy is going to work better, over the long run, than trying to sell at tops and buy at bottoms. Don't get me wrong. We want to trim overextended positions at appropriate times and try to buy at the best entry points possible. But we have to accept that corrections are just part of the game. In a correction, the focus should be on stock selection and then preparing to put your capital to work. To answer the question in the subject line, it depends how you define a bigger decline. Does that mean $1690 and $21, like I mentioned in the article? Perhaps. If Gold does not make a new low, and bottoms around the 300-day moving average, then I would not characterize that as a bigger decline. I'm leaning towards that scenario right now but that is a guess as I don't have enough info to give it a high probability. Over the days and weeks ahead we'll get more data (sentiment, price action, etc) and that will give us a better idea. In the meantime, I'm going to continue to try and find the future 5 and 10-baggers that have not moved yet. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|