|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Gold Stocks Bottom, But....

Published: Mon, 12/07/20

|

|

|

I wrote my article a few days ago. Gold & Gold Stocks Bottom but They Need to Improve Their Relative Strength.

The stock market has roared higher but there are major warning signs in sentiment. Take a listen to this video. What Will Cause the Next Crash and When? In this interview, conducted last Wednesday I discuss the interplay between reflation, inflation expectations, bond yields & Gold. Click here to listen.

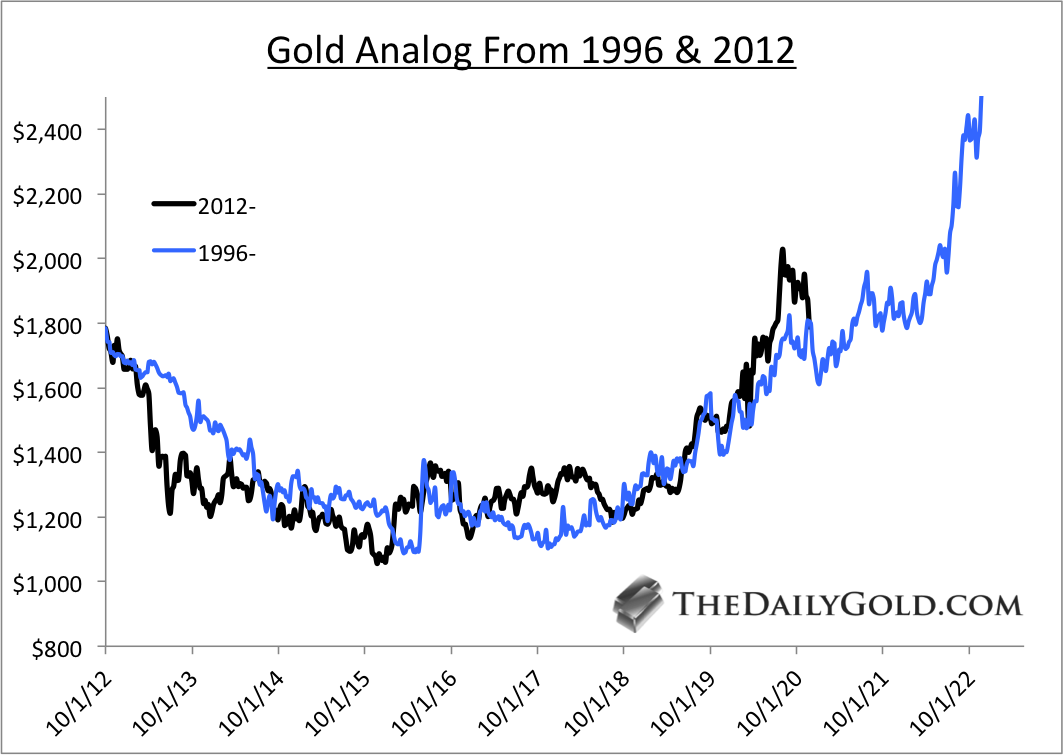

I continue to think this is the best analog for Gold. Time will tell if it follows the 2004-2005 pattern or something similar. The analog projects to $3,000 in Q1 2023.  Moving onto TheDailyGold Premium... In TDG #702 & TDG #703 we analyzed the potential bottom in the sector and gave our view of the outlook moving forward. We looked at historical comparisons as well as points in bull markets when the dollar was weak but precious metals did not respond.

In TDG #703 we provided something very helpful for new and potential new subscribers. We made a table of stocks we would start a new portfolio with. This included their Friday close, strong support level, as well as their upside potential in 18-24 months and their upside potential in 2-3 years. Here's an example. One stock has a market cap below $300 Million. We forecast it as having 3x-4x potential at $2000 Gold in the next 18-24 months. We forecast it as having 6x-7x upside potential at $2300 Gold in 2-3 years. I published this information in an easy to read and digest table, for a total of 9 stocks. It's on page 3 of TDG #703. I’ll keep this quick as I’m sure you’re busy right about now! First off, GREAT JOB with your calls recently! I feel much more confident navigating my gold investing with you in my corner! Also, I really appreciate the “buy, hold, accumulate” rating in your newsletter.

That is very helpful for me.

Thanks much sir. You are calling this great so far. Better than all others and will get credit.

First, a compliment. I so appreciate your well researched, thoughtful reflection with specific, clear stocks that have 5 bagger potential. You make it look easy (with only hundreds of hours of research) to find great opportunities.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|