|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Should Gold Bulls Worry About a Market Crash?

Published: Tue, 02/16/21

|

|

|

I've received quite a few emails from people who are concerned about a potential stock market crash and its impact on Gold and gold stocks.

I published a long article that is mostly text but includes three charts. It is roughly 3x as long as my usual articles. Click here to read my article. Here is a video I published a few days ago on the volatility indicators for Gold and what that they imply now and potentially later this year. Click here for the video. I've been following Frank Barbera for almost 20 years. He has followed gold stocks (from a technical point of view) since the 1980s. He was quite a bit more active in the 2000s, but stopped writing his newsletter in 2014. Anyway, he just this piece last week, which aligns with my last email about a bottom in the sector. Having read your past months' newsletters i notice your forecast about when both gold and silver next leg up will take place is less optimistic than other precious metals commentators who assert it is imminent. To be honest your relative "pessimist" medium term future price evolution forecast has proven to be more accurate than the other more optimistic analysts.

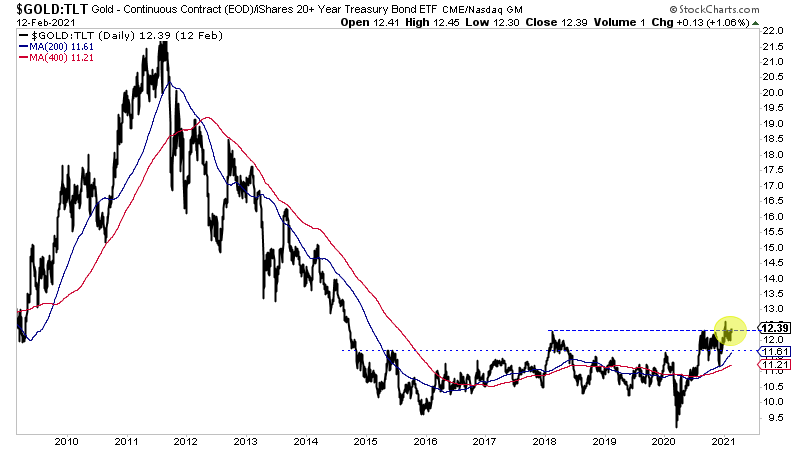

This chart plots Gold against TLT, the largest proxy for Bonds. Gold has been getting hit due to the rise in bond yields. I've explained how initially that would be negative for Gold. However, this ratio shows that Gold is on the cusp of breaking to a 6-year high against Bonds. That signals Gold is trying to decouple from Bonds, which have dragged down Gold.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #713, we included an updated report on one of our favorite companies. This exploration company is a high quality company with strong fundamentals. They have a project that has a chance to be a tier 1 asset, and almost certainly will be acquired by a major. Back in July 2020, the stock was 9% of our portfolio and the second largest position. It was due for a correction along with the sector. A week ago it was down to 5% of our portfolio and the 9th largest position. So we bought more. The stock has corrected and in my updated report, I showed the math which justifies minimum upside potential of 3x, with 4x as a reasonable expectation. If Gold breaks past $2,100 within the next two years, someone could overpay for the project and the stock could have nearly 5x upside. Why dick around with high-risk exploration stocks when you could buy a top-tier company with 4x potential? Thanks a lot for the update on (redacted). Very well written. I really enjoy your company updates. And I think I'm going to swap out of (redacted) in favor of (redacted) now.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely

provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149

|