|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Gold Stocks Should Bottom This Month...

Published: Wed, 03/03/21

|

|

|

The bottom we were looking for did not hold.

Nevertheless, Gold and gold stocks are moving closer to a bottom. This article was published a few days ago and it contains downside levels of focus for Gold, GDX and GDXJ. Click Here to read the article I just published this video a few hours ago. Here I explain why Gold is correcting and what it may be signaling, as far as the broader macro-market picture. Click Here for the video. Earlier Tuesday, I did this interview with MiningStockDaily. We talked about recent market action and how I use a combo of technicals, macro fundamentals, sentiment and intermarket analysis in my work. Click Here to listen. Last week, I did this interview with Kai Hoffman. We talked about Gold needing to outperform the stock market and my Gold target in 2-3 years. Click Here to watch. Having read your past months' newsletters i notice your forecast about when both gold and silver next leg up will take place is less optimistic than other precious metals commentators who assert it is imminent. To be honest your relative "pessimist" medium term future price evolution forecast has proven to be more accurate than the other more optimistic analysts.

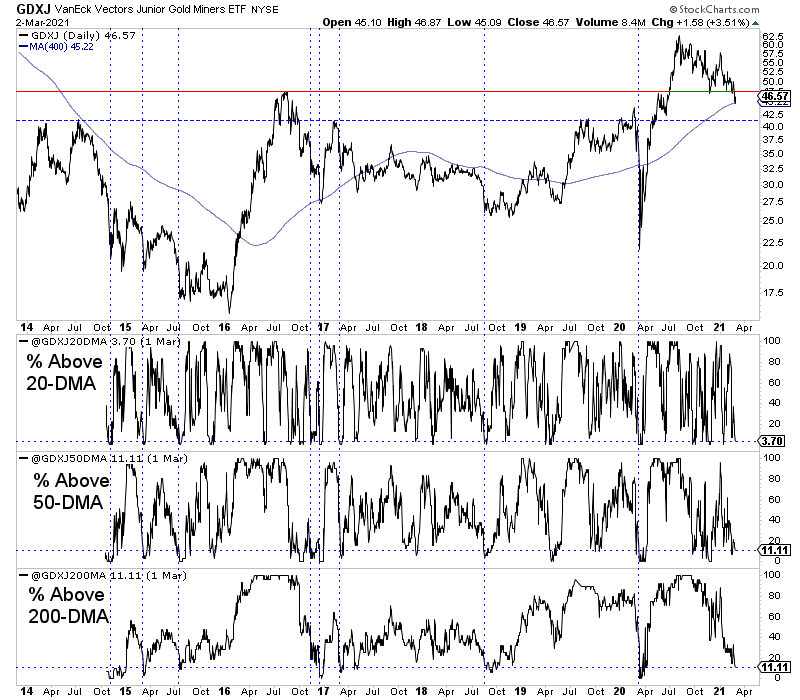

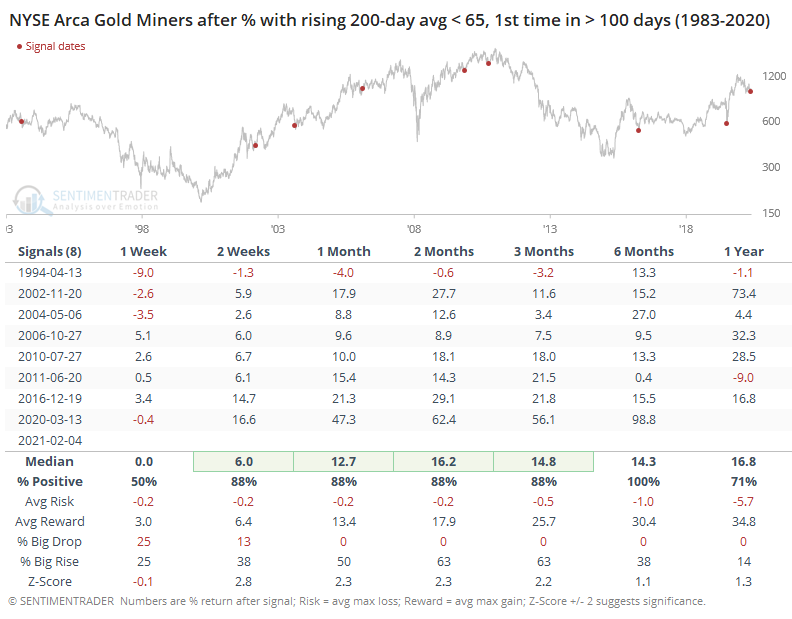

The chart below is GDXJ with my breadth indicators. The price bounced off the 400-day moving average, which has been important support/resistance since 2011. I'm not sure that's going to be the bottom so I'm also looking at $42. The vertical lines show similarly oversold points (based on breadth). GDXJ is setting up for a good rebound.  Here is a chart from Sentimentrader.com. It shows points when the % of gold stocks with a rising 200-day moving average fell below 65% for the first time in over 100 days. The median gain over the next 2 months was 16%. The 2004 and 2016 signals led to 13% and 29% gains over the next 2 months.  Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

New-ish subscriber here. Big fan of your work. Your sober analysis of the precious metals market has proven far more accurate than the other voices in the space. So thank you for that. In TDG #715, we provided technical analysis of the sector, our holdings and included targets for Gold. We also noted the current macro outlook and the potential for a Bond rally, US$ rally and what that might indicate for the Gold/Silver ratio. We also published a flash update, noting historical comparisons for this selloff and where Gold fits into the current macro outlook. TDG Model Portfolio has held up really well since August and is essentially flat since the sector peak in August. I did trim positions along the way. Nevertheless, we could have trimmed a few more things in last month or two and built up more cash. One reason to trim something or sell half is it doesn't have 3x upside over the next 18-24 months. Focus on quality. The best stocks, the best juniors will come back the strongest after a severe correction like this. Optionality plays, higher cost producers and most exploration companies will not come back until Gold begins an impulsive leg higher. There will be plenty of time to get into those types of plays. But quality companies that had 3x to 5x upside a few months ago now may have 5x to 7x upside. That's something I'm going to reexamine with our holdings. Thanks a lot for the update on (redacted). Very well written. I really enjoy your company updates. And I think I'm going to swap out of (redacted) in favor of (redacted) now.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely

provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149

|