|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold's Super Bullish Cup & Handle Pattern....

Published: Wed, 01/20/21

|

|

|

The precious metals sector is experiencing a correction. But in what context?

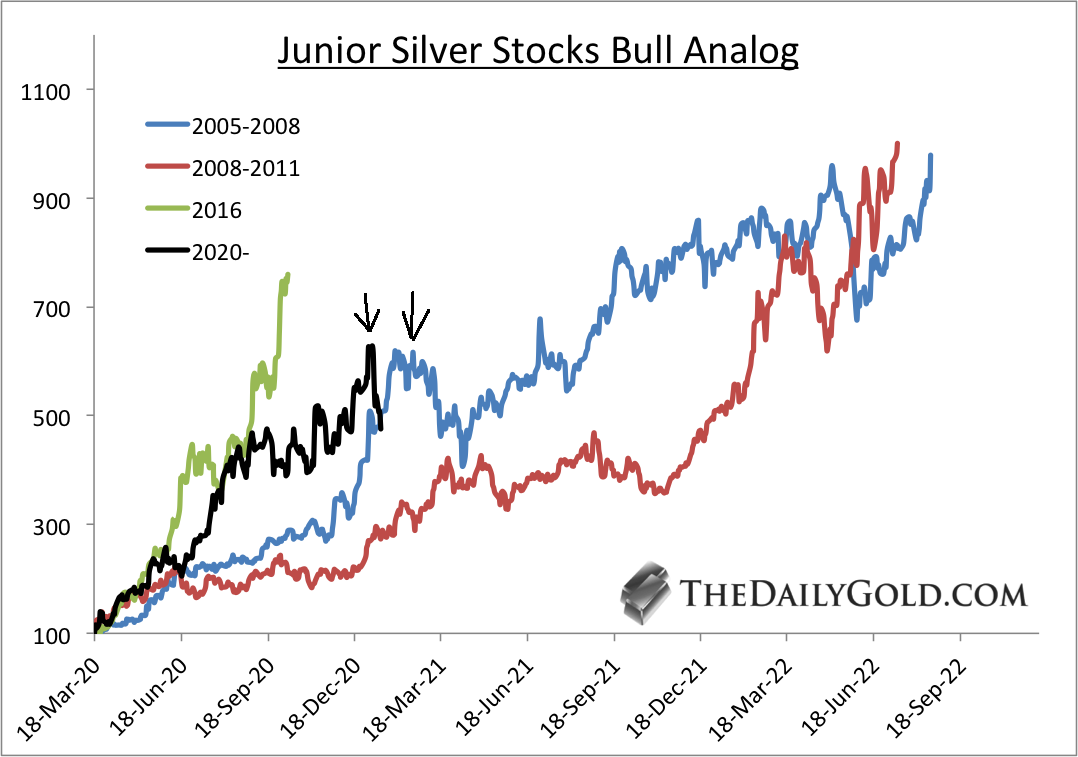

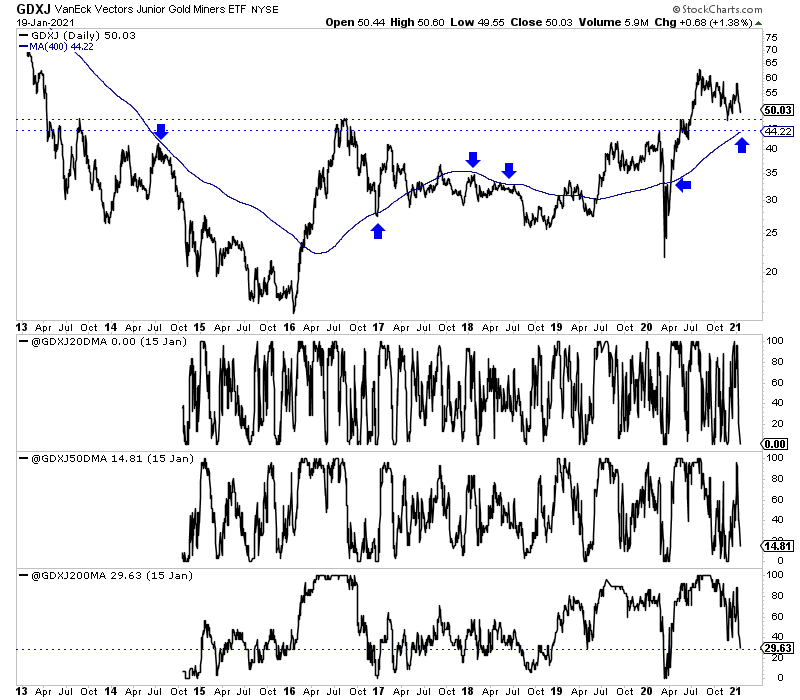

There's a good chance this correction is the handle part of a cup and handle pattern. Click here to read my article about what this could mean for Gold over the next few years. For more "near-term" analysis, here's a quick video analysis of a key level in both Gold & GDX. First, a compliment. I so appreciate your well researched, thoughtful reflection with specific, clear stocks that have 5 bagger potential. You make it look easy (with only hundreds of hours of research) to find great opportunities. I've been lukewarm on silver stocks in recent months. I've been asked constantly about buying silver stocks. It is not the time. The black line is the current index of 9 junior silver stocks. Its corrected 24%. The blue line (2005-2008) corrected 35% at this comparable point.  Here is a weekly line chart of GDXJ, which closed at $50. The chart includes the 400-dma and 3 breadth indicators. Those are the percentage of GDXJ stocks that closed above the 20-dma, 50-dma and 200-dma. Breadth is close to extremely oversold while GDXJ has strong support at $47 and the 400-dma near $45.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #709 we focused entirely on the technicals for Gold and gold stocks. (Silver has support at $22 and $21). The key levels for Gold right now are the November low around $1770 and then the 300-dma at $1745. Worst case is that support at $1690. As for the gold stocks, take another look at the GDXJ chart above. They are approaching very strong support and breadth indicators are already oversold. Do they plunge to a low or do they make a weak rebound and drag it out where it is more unpredictable? I'm cleaning up the model portfolio a bit and trimming/selling some underperforming positions. One reason to sell is to replace an under-performer with something that has a better outlook. Its tough to buy when sentiment is the way it is now but that is when you want to buy. I expect the sector will make a low and rebound sometime over the weeks ahead. Time will tell but the coming low could be a higher low. Eventually Gold could break out of that massively bullish cup and handle pattern and run towards $3000/oz within a few years. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|