|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Stocks Approaching Bottom...

Published: Mon, 02/01/21

|

|

|

The precious metals sector (well Gold and gold stocks especially) continues to correct.

The gold stocks are oversold. Breadth indicators are oversold. But they have not hit extremes yet, nor have GDX & GDXJ tested very strong support levels. Hence, the gold stocks are APPROACHING a bottom, but are not quite there. Read my article here. If you prefer that analysis in video (but is a few days old), then take a look and listen to my analysis here. This has been a period of rising inflation expectations. Are we going to see that continue or even intensify? Or are we headed for another deflation scare first? Consider what two of the best Gold-Macro analysts (in my opinion), think. Here is Steve Saville's take- Rising Fear of Inflation Here is Gary Tanashian's take- Can the Silver Bugs Alter the Macro?

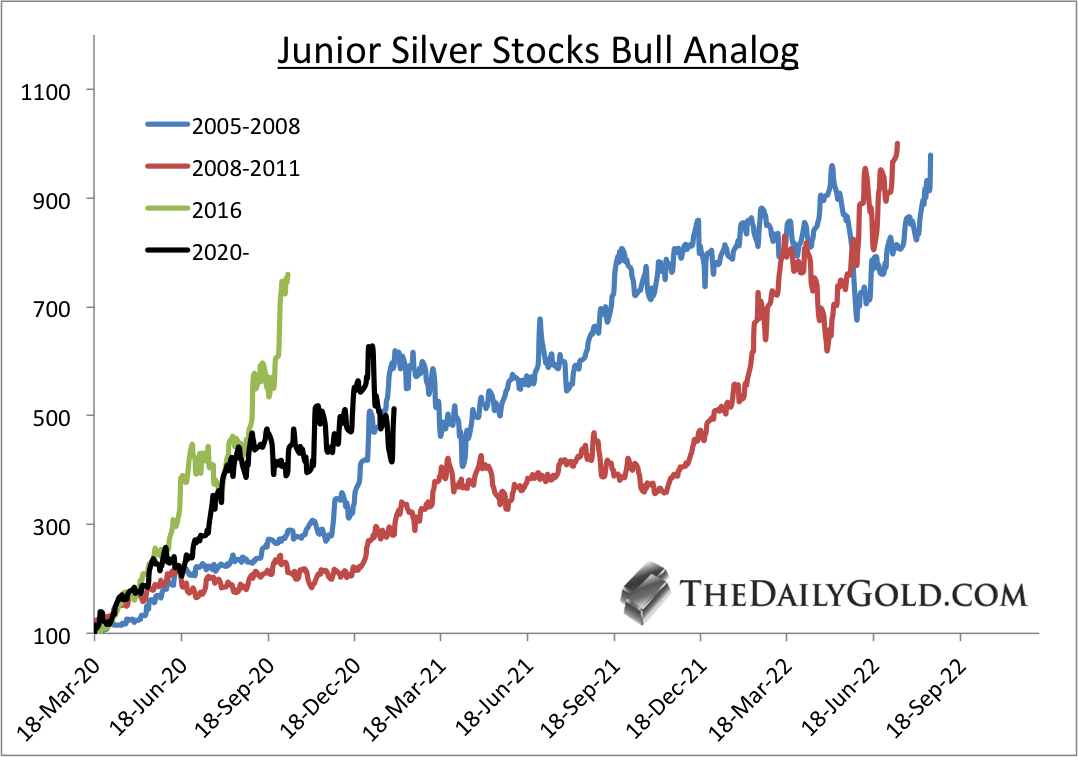

The black line is the current index of 9 junior silver stocks. It has rebounded after a quick drop. Silver is up 9% as I pen this (Sunday night on the west coast). I'm intrigued to see what happens to silver stocks. But they, like Silver, are not exactly at a floor. I don't know that a short squeeze is the start of a huge move higher or just a pop that inevitably is retraced.  Moving onto TheDailyGold Premium... Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

In TDG #711 we focused on buy targets and support targets for our favorite stocks along with the growing fear that there is going to be another crash in the stock market that will take down precious metals. Didn't we just experience that 10 months ago? The important point that many are missing is precious metals have corrected for 6 months while stocks, crypto, tech stocks, etc have soared. A serious correction in tech or the stock market, or a contagion-type of selloff precipitated by hedge funds going bust may hurt precious metals far less than you'd expect. Everyone is remembering the Covid crash and 2008. Positioning is different right now. Moreover, a selloff in the stock market might be what is needed to bring an end to the correction in Gold and gold stocks and set the table for a sustainable rebound that leads to the next big breakout. But I did give potential GDX & GDXJ targets if there were to be a contagion type of selloff. Its tough to buy when sentiment is the way it is now but that is when you want to buy- and when stocks are nearing support. In TDG #710 I mentioned an exploration company which has corrected significantly but is likely within 10% of a final low. Their deposit has tier 1 potential and I project this stock has up to 4-bagger potential. Buy high quality and buy it as cheap as you can. If we go 10% lower in some of my favorites, that will only enhance your potential upside over the next few years when Gold surges past $2100/oz towards $3000/oz. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|