|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: The Most Important Indicator for Gold...

Published: Wed, 04/07/21

|

|

|

The most important indicator for Gold, depending on your persuasion is price (duh) or real interest rates. Gold moves opposite the trend in real interest rates.

But I'm not talking about that. I'm talking about something more important and it is something of a fundamental indicator. Click here to read my article. Yesterday I did an interview with Trevor Hall of MiningStockDaily. This covered quite a bit of my current thoughts. It was meant to be 15 minutes but of course I rambled on. Click here to listen. Last Friday I did an interview with Bill Powers of MiningStockEducation. I spent some time talking about that most important indicator. Click here to watch and listen.  Having read your past months' newsletters i notice your forecast about when both gold and silver next leg up will take place is less optimistic than other precious metals commentators who assert it is imminent. To be honest your relative "pessimist" medium term future price evolution forecast has proven to be more accurate than the other more optimistic analysts.

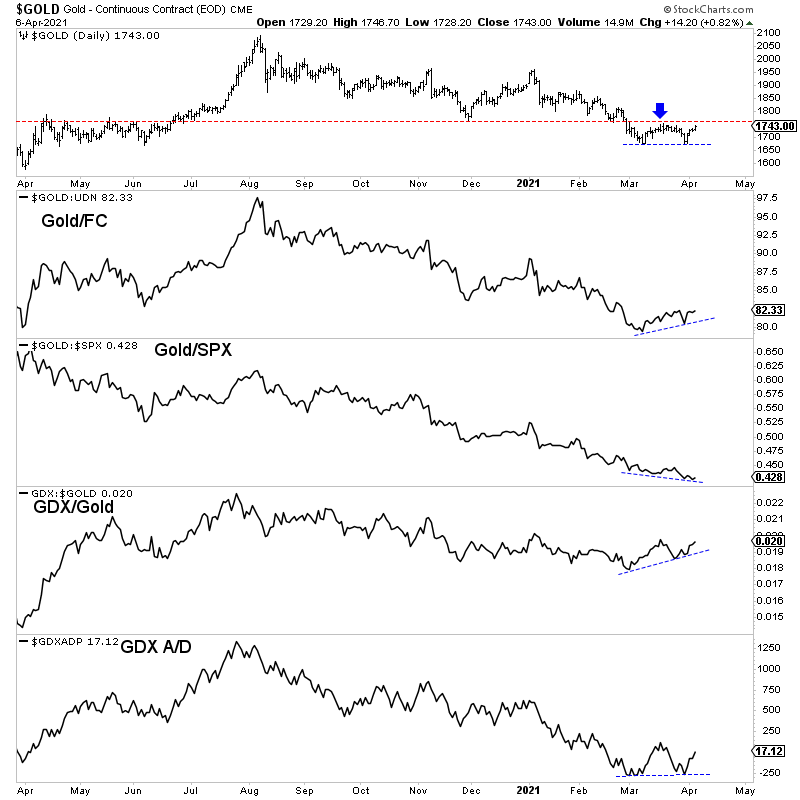

Take a look at this chart... I call this my leading indicator chart for Gold. It includes some ratios & a breadth indicator.  Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

New-ish subscriber here. Big fan of your work. Your sober analysis of the precious metals market has proven far more accurate than the other voices in the space. So thank you for that. TDG #720 we focused on the portfolio and watch list. Specifically, we focused on the 7 or 8 stocks we felt could be long-term holds. We are confident these companies will add significant value, even if the Gold price averaged $1550-$1800 over the next 18 to 24 months. (There are 3 ways a company can add value. I'll cover this in an upcoming video. It's not only a trite phrase). We also deemed one of those top 8 stocks, our top silver stock. This stock has potentially 3x to 5x upside over the next 2-3 years at $25 Silver. I love their business plan. Management has a strong track record. If we get $50 Silver within 3-4 years this has 10-bagger potential. In addition, we commented on our watch list and what company is best positioned for a flat market, and our 2 favorite micro-cap companies. Both of those are sub $35 Million market cap with pretty good fundamentals. Technically, Gold has upside potential to $1825, GDX has upside to $36-$37 and GDXJ to $51-$52. I love trying to find the next big winners for subscribers. There is a lot of quality out there to be had with 5x, and 7x potential over the next few years. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149

|