|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold's Path Forward...

Published: Wed, 03/10/21

|

|

|

Gold has endured a severe correction that has inflicted quite a bit of technical damage. So, what are the implications now? We discuss in an article penned a few days ago. Click Here to read the article.

If you prefer to watch a video on that, consider this one. We analyze one chart from the article plus another, and comment on the potential paths forward. Click Here to watch the video. You are reading this email on Wednesday, but look for more content on TheDailyGold.com, by the end of the week. Also, check out this post from Steve Saville, who is a great follow for tracking Gold's fundamentals. He says the US economy is in its boom phase but it will be short lived and lead to stagflation. Click Here to read his post.  Having read your past months' newsletters i notice your forecast about when both gold and silver next leg up will take place is less optimistic than other precious metals commentators who assert it is imminent. To be honest your relative "pessimist" medium term future price evolution forecast has proven to be more accurate than the other more optimistic analysts.

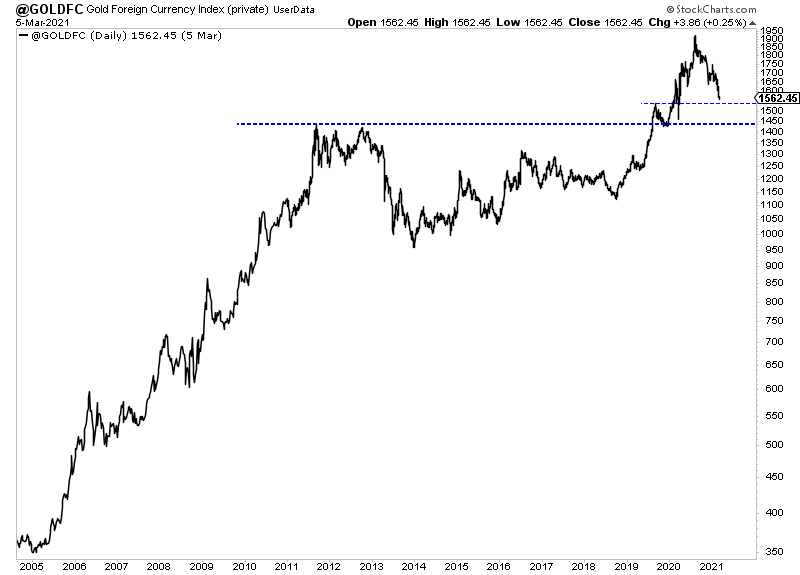

The chart below is Gold against foreign currencies. It's also equivalent to Gold x US$ Index. It removes dollar weakness from the equation. Gold/FC has about 8% downside to a confluence of very strong support. Its the 50% retracement, the 2011 peak and also the 40-month moving average is there.  Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

New-ish subscriber here. Big fan of your work. Your sober analysis of the precious metals market has proven far more accurate than the other voices in the space. So thank you for that. TDG #716 included an ample amount of Q&A, and technical review on majority of our stocks. We also assessed our gold producers and developers. We covered recent developments as well as their potential upside over 2-3 years. Cash is always important (for companies) and something to keep in mind especially now for a few reasons. If companies have to raise soon then they will be doing it at lower prices (as compared to 6 months ago) and this in itself can keep the stock under pressure. Companies that have to raise significant capex (and planned on using part equity) may have their construction delayed. Companies that are cashed up will face less selling pressure than others. This creates opportunities. For example, companies that sold off heavily with ample cash, will face less selling pressure moving forward because they won't have to raise. Also, the other side is companies that will have to raise could end up being bought at a discount, as their stock gets pressured lower ahead of a raise. Quality companies that had 3x to 5x upside a few months ago now may have 5x to 7x upside. That's something I'm reexamining.... Thanks a lot for the update on (redacted). Very well written. I really enjoy your company updates. And I think I'm going to swap out of (redacted) in favor of (redacted) now.

"I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely

provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity.

-Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149

|