|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Dollar Rally is Gaining Traction & What it Means...

Published: Mon, 03/29/21

|

|

|

In recent months capital has favored inflation investments. Bond yields have pushed higher as well as hard assets.

But the dollar formed a bottom and has emerged from that bottom.... What is the outlook for the dollar and what are the implications for commodities & commodity stocks? Click Here to view our analysis. If you did not watch my video last week, then you can read the article. I write about the 5 common flaws many junior miners can have. Click Here to read the article. Larry McDonald was a trader for Lehman. He is one of the best market timers I've ever seen. This interview is a few weeks old but still relevant. Read why he thinks the Fed will have to do yield curve control soon and that could mean 50% upside for Gold and 100% upside for Silver. Click Here to read Larry's interview. If you prefer audio/video, Larry also did an interview with DoubleLine Capital, Jeff Gundlach's firm. This is excellent macro/market commentary. Click Here to see the interview.  Having read your past months' newsletters i notice your forecast about when both gold and silver next leg up will take place is less optimistic than other precious metals commentators who assert it is imminent. To be honest your relative "pessimist" medium term future price evolution forecast has proven to be more accurate than the other more optimistic analysts.

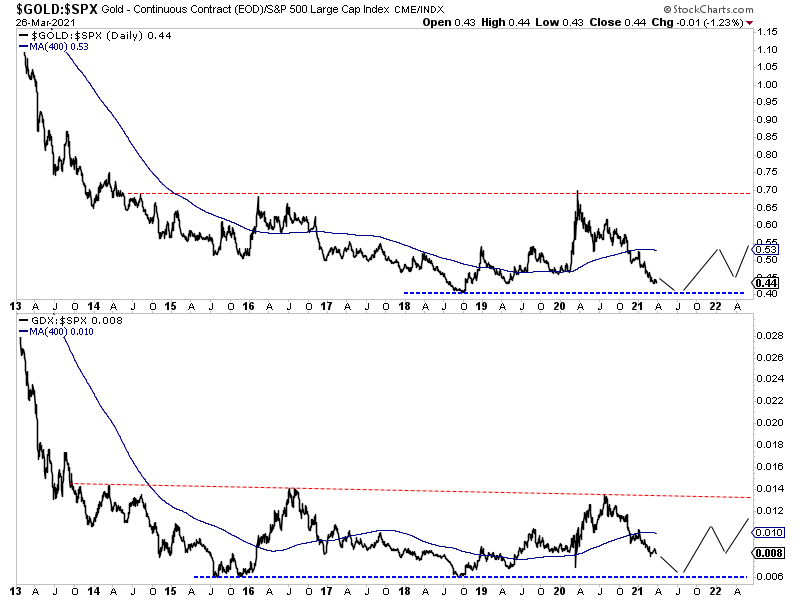

One of the most important charts.... For us gold investors, this is one of the most important charts and maybe the most important. We plot Gold vs. S&P and GDX vs. S&P These ratios have declined in recent months and it hasn't stopped. It looks like both ratios are going to retest the lows. Over the months ahead we will be looking for a rebound in these ratios. Eventually, they will push higher and break resistance around the time Gold probably breaks above $2100.  Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

New-ish subscriber here. Big fan of your work. Your sober analysis of the precious metals market has proven far more accurate than the other voices in the space. So thank you for that. TDG #719 included, among other things, charts on the majority of our holdings. We note the key support levels that are at risk of being tested but would also be good entry points for those without a position. In our model portfolio spreadsheet we added a column noting the closing price and key support levels. So you can view quite a bit of information with one quick look. Over the past few updates, we've updated and commented on several watch list companies. These include..... - An exploration company with a market cap of US $222 Million and a project with potentially +2M oz Au and those are high margin ounces. These projects can be acquired for $250/oz. This would be a solid buy if the stock corrected. -A similar company who is not as far along. They likely have 1M oz Au with potential to get to 1.5M-2.0M oz Au. And these look to be high-margin ounces. The company has a market cap of only US $28 Million. -A company we moved higher up on our watch list. They are working in a hot area but no one is covering them. They already have close to 1M oz Au, US $6M in cash, and a market cap of US $40 Million. They have a very strong management team fresh off a big success. This is a hidden gem! I love trying to find the next big winners for subscribers. There is a lot of quality out there to be had with 5x, and 7x potential over the next few years. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149

|