|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Time for Consolidation & Lower Volatility in Gold...

Published: Wed, 06/16/21

|

|

|

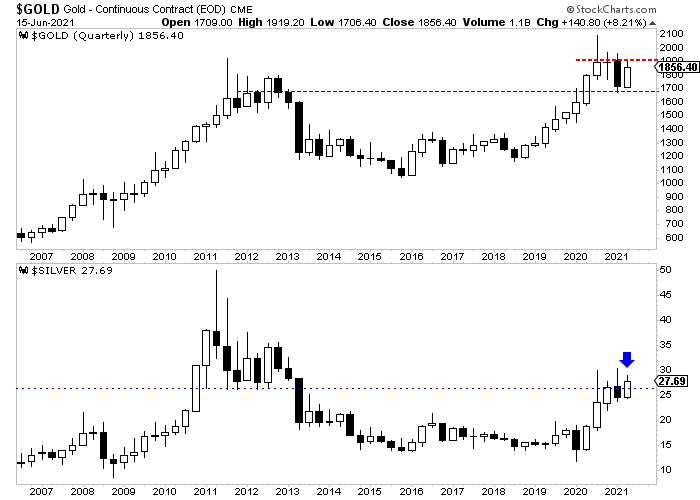

Gold corrected 20% over 8 months. Then it rallied nearly 15%, into stiff resistance. Earlier this year my thinking was Gold would rebound and then grind into year end.

Has the grind started? Click Here for my article The macro-market landscape, which has been all about rising inflation, could be shifting. There are early indications of such. I published a video Tuesday and provided my analysis. Click Here to watch my video   Subscribe to TheDailyGold Premium for Only $149

------------------------------------------------------------------------------------------- The end of June is the end of the quarter. Let's take a look at the quarterly charts. $1900 for Gold is not only weekly and monthly resistance but its quarterly resistance too! I don't think Gold will close above $1900 at the end of this month. Nevertheless, it does have a shot to make its 3rd highest quarterly close ever. If Silver closes at $26 or higher it would be the highest quarterly close in 8 years.  ------------------------------------------------------------------------------------------- In TDG #730, one Q&A regarded my investments in silver companies. I do own a few private silver companies but amongst the public companies, I only hold a few. I hold more gold stocks. For me, it's about the quality of the company first. That won't become second or third until it appears Silver is on a path to run to $50. Then anything Silver will run. I owned more silver companies back in 08-09 because the quality of the junior silver companies then was quite strong. Today, I see far more quality in the junior gold area. Also, it's a value issue. The silver space is small due to the mega-bear market from 2011 to 2018. There aren't that many companies. If Sprott invests in one and the company has a few good drill holes it can go to a $200 Million valuation. With slick marketing and competent management, new co's can go to a $100 Million valuation (without a significant resource or too many holes). Retail investors need to know what they are getting into here. What if Silver doesn't breakout soon? What if it drops to $22? What if these companies have mediocre or marginal results? I do have one junior silver company on my watch list and it has sold off. I don't feel the need to rush into anything silver right now unless the value is compelling. My thinking is there will be more opportunities and better value over the months ahead. "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|