|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: 3 Charts That Show Gold is Still Dirt Cheap...

Published: Mon, 05/17/21

|

|

|

I hope you had a good weekend.

Precious Metals are testing resistance here. Gold, Silver, GDX, GDXJ all are testing important resistance. My base case is a grind for the bulk of the year. But I could be wrong. Market timing is important but you should use it in conjunction with company analysis to determine buys and sells. For example, company A could be a buy or accumulate at this price and time, but company B no. Periodically I review the potential upside of my holdings as it helps gauge value in nominal and relative terms. So I looked at my current producer and developer stocks, which is less than 10 companies. 3 stocks have 10-bagger potential- and they don't require $3000 Gold or fanatical prices to get there. (I may add to one of those positions soon as this quick study showed it has significant value). Should Gold go to $3,000/oz, I could see 2-3 others coming close to 10-baggers. Folks, these are good companies that would perform even with flat metals prices. If you're not a subscriber yet, would you like to know these companies with quality attributes and huge potential? Or are you going to wait until Gold breaks $2,100 and all these stocks have already doubled? "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- It looks like Bitcoin & crypto are dumping. I did a video commentary on this the day after my most recent email to you. Click here to watch the video. Oh I forgot about the 3 Charts. See them in this article. Click here to read my article Here's another video for you. These 2 charts show a repeat of the 1970s for Gold & gold stocks. Click here to watch my video This is a video interview I did a week ago with SilverBullionTV. I appreciated the clear questions. Click here to watch my video -------------------------------------------------------------------------------------------

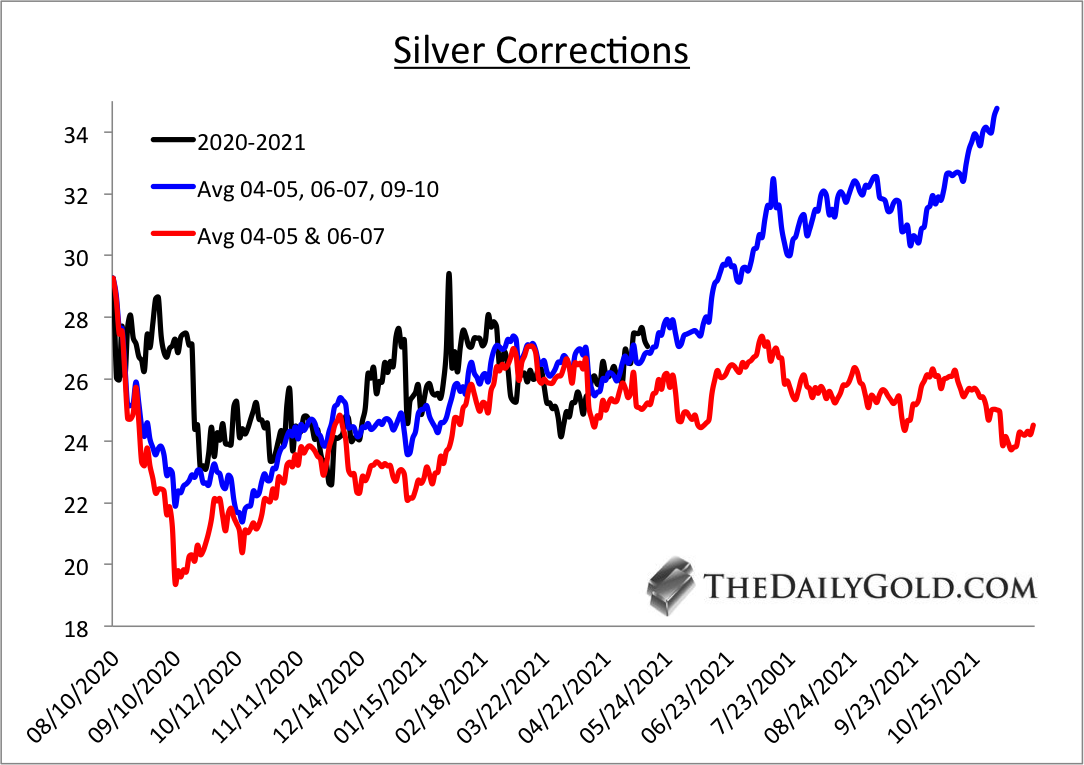

Here is a look at how the current correction/consolidation in Silver compares with those in 2004-2005, 2006-2007 and 2009-2010. If we remove 2009-2010 (when Silver exploded at this point), we see the average of the other two (red) implies a consolidation until October, when the market would push to new highs. Silver has held up better than I anticipated.

------------------------------------------------------------------------------------------- Jordan's newsletter The Daily Gold is the best deal in precious metals investing. He is sharp, experienced, honest, doesn't overhype, disciplined, and he is killing it in this bull market with well researched picks that are outperforming the GDX & GDXJ with less risk and better

upside in my opinion. Seriously, check it out.

Subscribe to TheDailyGold Premium for Only $149

|